Amcor (AMC) This morning, the world’s largest consumer packaging company announced a merger with Berry Global Packaging for US$8.2 billion. The HNW Portfolios have a 4% weight to AMC.

Key Points:

- Merger Details: Amcor is acquiring global packing manufacturer Berry Global for US$8.4 billion in an all-script deal. Berry shareholders will receive a fixed 7.25 Amcor shares per Berry share, giving Amcor shareholders 63% of the combined business. The merged company will be dual-listed on the NYSE and ASX. Both boards have approved the deal, so there is unlikely to be a bidding war for Berry. The deal is expected to close in June 2025.

- Why are Amcor doing this deal? Berry Global packaging specialises in containers and closures, highly complementary to Amcor’s flexibles range (See Below). The combined business can service more customers and produce higher cash flows, which can be reinvested in R&D spend (which will double) to produce higher-quality and higher-margin products. Berry’s business enjoys higher profit margins than AMC’s and has greater health and medical packaging exposure.

- Synergies to Come? In the first year, the combined business will see Amcor have over 75,000 employees and 400 manufacturing plants, producing US$24 billion in revenue and US$4.3 billion in earnings. After the first year, US$650 million in synergies will be achieved through procurement and financial synergies in three years. AMC will now be the largest buyer of resin globally, buying US$12 billion annually, and we would expect some plant rationalisations.

- Outlook: Atlas sees this as a solid acquisition and is funded by equity issued at a minimal premium rather than debt, a prudent move. AMC has doubled down on higher margin specialist packaging in health and medical. According to our numbers, the acquisition results in a 10% boost in earnings per share to US$0.84 when 40% of synergies (mainly procurement) are achieved.

AMC finished down 19c to $15.51 (effectively unchanged with AMC trading ex a 19.2 cent dividend today). The ASX200 finished down -0.6%

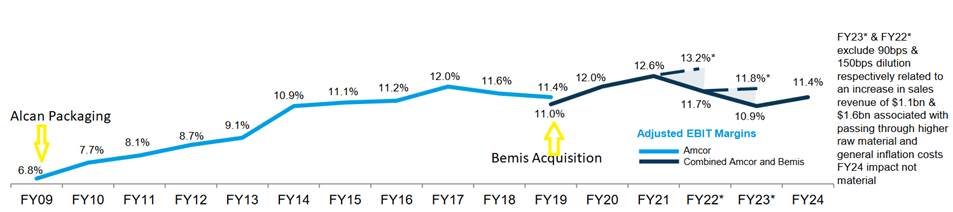

Portfolio Strategy: Amcor is the largest global packaging company with operations in 43 countries. While packaging is not the most exciting of industries, Amcor exposes the portfolio to global growth in consumer and medical goods and manufacturer demands for increasingly sophisticated packaging. 95% of AMC’s customer base is in consumer staples, such as packaging for meat, cheese, sauces and condiments, beverages, coffee, pet food, healthcare and personal care products, all of which have stable defensive characteristics. AMC currently trades on a PE of 13x with a full-year dividend yield of 5.5%. AMC has a good long-term record of integrating acquisitions, realising synergies and improving profit margins.