ANZ Bank (ANZ) released its full-year results, which came in around market expectations, highlighting the increased competition in deposits and lending and the acquisition of Suncorp Bank. ANZ is the last of the big four banks to report this season, with CBA to give their third-quarter update on Wednesday next week. A solid result with few surprises. The HNW Portfolio holds an 8% weight to ANZ.

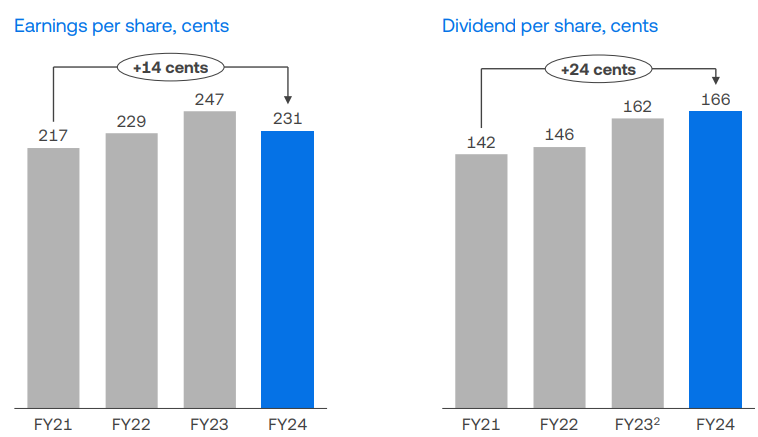

Profits Down: ANZ reported net profit $6.9 billion which was down on the record year of 2023 but similar to Westpac saw improving profit over the second half of 2024.

Net Interest Margin (NIM) Slightly down: ANZ Group NIM remained flat through the year, benefitting from strong margins in their capital portfolios, offsetting lower margins on mortgages that saw increased competition in Australia and New Zealand.

Low Bad Debt: Bad debt remains incredibly low at 0.07%. Similarly to the other major banks, ANZ has been able to manage the risk well, with 99% of their mortgage loans on a variable rate up from 95% of customers in 2023. The “fixed rate cliff” from December 2022 that was going to see bad debts spike and plunging bank earnings seems to be put to bed.

Suncorp Acquisition: Over the half ANZ completed the acquisition of Suncorp bank, which has provided ANZ with $69 billion or 2.5% more market share in Australian mortgages but also $53 billion of deposits, making it the second largest Australian bank by deposits, and 1.2 million customers.

Strong Balance Sheet: ANZ currently has a capital ratio of 12.2% after the acquisition of Suncorp Bank, which is well above the APRA minimum capital target requirement of 11.5%.

Show Me the Money: ANZ’s dividend increased by 2.5% to $1.66 per share, 68% franked, representing a payout ratio of 76%.

Guidance: ANZ did not provide any business guidance but noted that they are continuing to build out their new ANZ Plus offering which will decrease costs and increased productivity over the longer term, when the app is full rolled out to ANZ customer in 2027.

ANZ finished up 1.3% to $32.13.

CEP Strategy: We own ANZ in the Portfolio on both valuation grounds and the tailwinds the bank will enjoy over the next few years as Suncorp Bank continues to be integrated into the ANZ system and increase ANZ market share as well as rationalising its branch network. ANZ trades on an undemanding PE of 14x and a dividend yield of 5.1%, easily the cheapest of the Aussie banks.