This morning, Bapcor (BAP), Australia’s largest vehicle parts, accessories, and equipment provider, provided a trading update for its third quarter, which was poorly received by the market. The HNW Growth Portfolio only has a 2.5% weight to Bapcor.

Key Points:

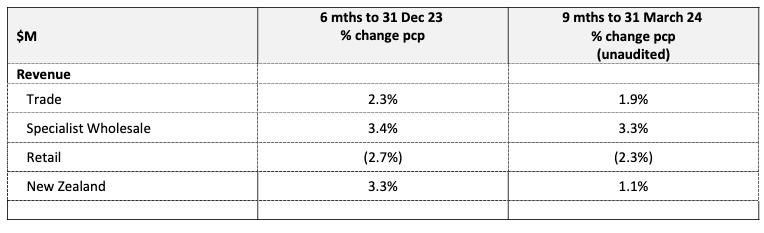

- Retail Sales Weaker: Management updated full-year profit guidance to between $93 million and $97 million, around 10% below what was communicated during the half-year presentation. This was primarily due to continued weak consumer confidence and low discretionary spending on high-margin items such as bull bars, which has seen retail sales fall by 2%.

- Trade & Specialist solid: Pleasingly, due to their non-discretionary nature, trade and Specialist wholesale businesses have continued to grow sales by 2% and 3%, respectively, with May and June historically being their strongest trading months. Better-than-before (BTB) cost-saving benefits will not occur during this year but have been pushed back to later this year which could save Bapcor $25 million a year once fully implemented.

- Why is the stock off so much?: On 30th April BAP revealed that the incoming CEO Paul Dumbrell, who was well regarded and due to start 1st May would not start due to a “personal decision”. What we are hearing is that this was due to issues with Chairwoman Margie Haseltine. This suggests a failure of due diligence on behalf of both the board and the incoming CEO. Management instability combined with a downgrade was always going to see a negative share price move. Atlas sees that today’s move is largely an overreaction by the market, with $10 million profit miss for FY24 leading to a $500 million lower market value.

Portfolio Strategy: Bapcor provides the Portfolio exposure to automotive parts aftermarkets across Australia and New Zealand through motor vehicles (Burson), Trucks (Truckline), Agriculture (Bearing Wholesalers) and servicing (Midas). Bapcor benefits from the constantly aging car fleets of Australia and New Zealand that require more frequent servicing, with the average vehicle age increasing from 9.5 years before the pandemic to over 11 years now. Over the medium term, Bapcor will benefit from the transition to EVs, with many components of EVs needing more regular servicing. While the retail result was disappointing, but we were pleased to see the resilience of the trade and wholesale car and truck part markets which as we expected are largely non-discretionary. Bapcor trades on 14x forward earnings with a dividend yield of 4.5%.

BAP finished down -24% to $4.40.