Macquarie Group (MQG): This morning, the global investment bank reported its full-year results for 2024, which were solid despite the half having much fewer investment banking deals and volatility in the marketplace. HNW Growth has a 6% weight, with HNW Income at a 5% weight, holding to the Vampire Kangaroo.

Key Points:

- More Normal Year: After two sensational years of higher volatility around oil and energy prices due to supply shocks from weather and geopolitical events, Macquarie’s full-year profit was down 29% but up +49% on first-half earnings, which was very pleasing. Macquarie Capital had a strong year, up 31% from a rotation of Capital into fixed income, growing their fixed income book to $21.5 billion.

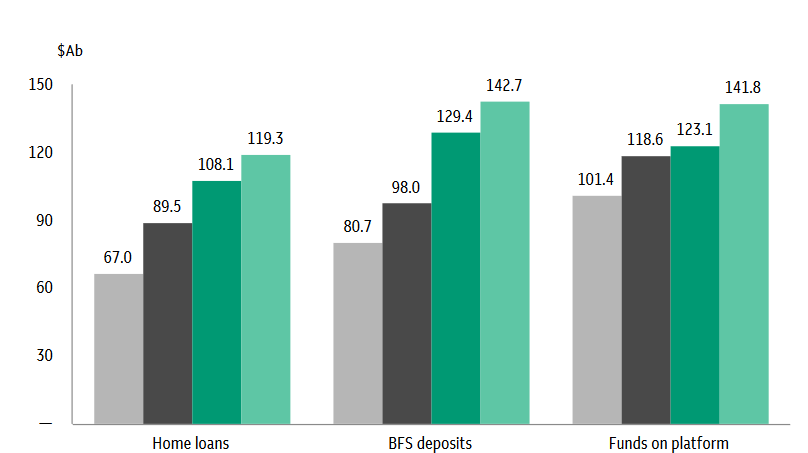

- Macquarie Bank: Profit from the bank was up 3%, driven primarily by a 10% increase in their home loan portfolio to 5.3% of the Australian market for loans and deposits and a 22% increase in business banking. Three years ago, sell-side analysts questioned why they would be involved in this business.

- Asset Management: Profits from this division were down 48%, driven by lower asset realisations in their green investments. However, pleasingly, Macquarie is continuing to grow its Asset Under Management to a record A$938 billion and its more stable base fees. This augurs a solid result in funds management for Australia’s largest fund manager.

- Dividends down: -15% to $6.40 per share (40% franked), representing a payout ratio of 70%.

- On-Market Share Buyback: Macquarie has completed $600 million of on-market share buybacks, with $1.4 billion to be still completed of the $2 billion announced in November.

- Guidance looking good for 2025: MQG has historically provided downbeat guidance, citing the challenges rather than the positives, underpromising, and almost always overdelivering. But this year, Macquarie has provided very positive guidance regarding Macquarie Bank home loan growth, Asset Management to see significant increases in revenue from green asset realisations and Capital to see higher revenue from IPos in 2025.

CEP Strategy: Atlas’ preferred bank exposure is Macquarie Bank, which offers exposure to a global investment bank with a heavy weighting towards stable funds management earnings and will benefit from a falling AUD. Unlike the major trading banks that operate in a competitive oligopoly where any moves to grow market share are swiftly matched by the other banks, Macquarie’s growth is not constrained by Australian GDP growth, with 65% of revenue coming from international markets.

MQG offers investors both the “cake” of stable annuity-style profits from asset management to go with the “icing”, that is, the more volatile earnings that are derived from investment banking and trading in commodities and financial markets. MQG trades on an undemanding PE of 15x with a 4% yield.

MQG finished down 2% to $184 – a curious move after a strong second half and a bright outlook for FY25.