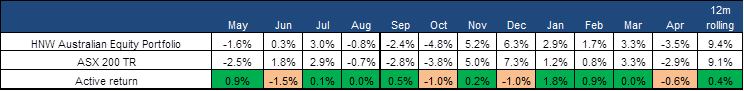

In March, the HNW Australian Equity Portfolio had a weak month down -3.58%, the Portfolio’s first down month since October 2023. Global equity markets fell between -3% and -5% over the month on market views that rapid and deep interest rate cuts this year could be unlikely as inflation continues to remain sticky across most developed economies.

Over the month, positions in Whitehaven Coal (+9%), Mineral Resources (+2%) and Suncorp (+2%) added value, with the new addition Whitehaven benefiting from both higher commodity prices and getting the keys to the BHP metallurgical coal assets on 2nd April.

On the negative side, the ledger performance was hurt by Sonic (-9%), Ampol (-7%), Macquarie Bank (-6%) and Woodside (-7%). These falls came on no news (SHL & MQG), with WDS weaker on a lower-than-expected realised oil price for the March quarter of US$63/bl; the June Quarter should see a recovery with the average price around US$85/bl. Ampol had a quarterly update, showing profits to be in line with Q1 2023, a record quarter.

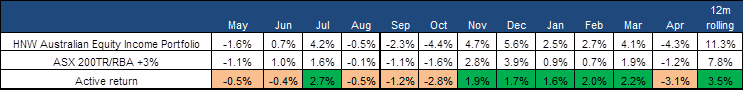

The HNW Equity Income Portfolio also had a weaker month down -4.27% trailing the blended benchmark’s return of -1.2%. This was expected as during the month as interest sensitive/dividend stocks were sold down the most. Positions in Charter Hall Retail (-10%), Region (-8%) and Arena REIT (-7%) hurt performance, with Mineral resources (+2%) and Suncorp (+2%) providing a small offset.