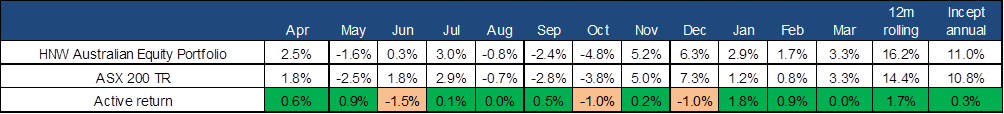

In March, the HNW Australian Equity Portfolio finished strongly to gain +3.30%, marginally ahead of the ASX200 TR +3.27%. Global markets were stronger on views that there would not be a hard landing in Australia and the US. The ASX appeared to benefit from capital inflows from Asian investors as well as a portion of the $34 billion in dividends being reinvested in the market.

Over the month, positions in Bapcor (+8%), QBE Insurance (+8%), Incitec Pivot (+7%), Amcor (+6%), Ampol (+6%) and Min Res (+7%) added value.

On the negative side of the ledger, Transurban (-2%) hurt performance after a noisy independent review of toll road pricing in NSW, which proposed changes to toll road pricing in Sydney. TCL said they welcomed toll reform provided the NSW state government compensates the company for future revenue lost in any restructuring of toll fares. Atlas see that this is political theatre rather than substance, as it is unlikely that the government will break iron-clad toll road contracts or write a very large cheque to reimburse TCL and its partners. In 2021 TCL and partners paid the NSW government $20B for the right to operate the 33km long WestConnex until 2060.

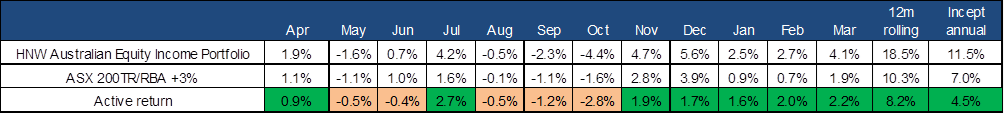

The HNW Equity Income Portfolio also had a very pleasing month up +4.1% and ahead of the blended benchmark’s return of +1.9%. The return was ahead of the “growth” portfolio due to some of the undervalued LPT positions having a very good months, namely Arena REIT (+17%), Dexus Industrial (+8%), Region (8%) as well as QBE Insurance (+8%), Incitec Pivot (+7%), Amcor (+6%), Ampol (+6%) and Min Res (+7%).

On the negative side of the ledger Transurban (-2%) hurt performance for reasons discussed above along with Westpac (-1%) on no new news.