In February, the HNW Australian Equity Portfolio had a pleasing month and a solid reporting season, gaining +1.67% and ahead of the ASX200 TR +0.79%

Over the month, positions in Wesfarmers (+16%), Mineral Resources (+11%), Suncorp (+10%), Ampol (+8%), QBE (+9%) and JB Hi-Fi (+10%) added value. On the negative side of the ledger, Lend Lease (-12%), Deterra (-8%) and Sonic (-7%) hurt performance. The reporting season was generally better than expected with the key themes being, 1) higher interest costs crimping profits from heavily geared companies 2) resilient consumer spending 3) inflation moderating and 4) companies doing a good job in controlling costs.

On a weighted average, companies in the portfolio increased dividends to our investors by +7.3% ahead of inflation which was 4.2% for the period. On this measure we are pleased with how reporting season went.

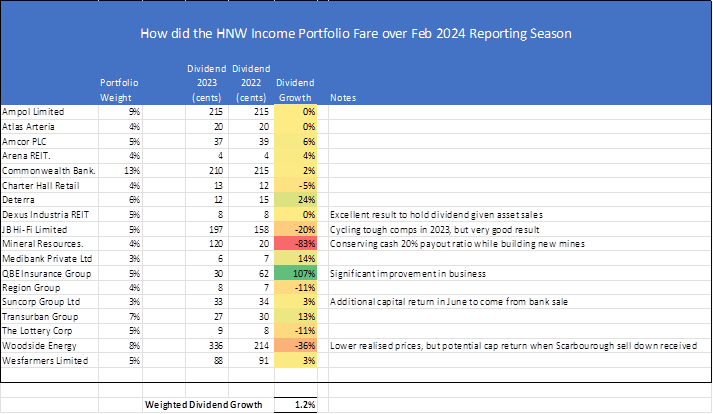

The HNW Equity Income Portfolio also had a solid month up +2.68% and ahead of the blended benchmark’s return of +0.69%. Positions in Wesfarmers (+16%), Mineral Res (+11%), Westpac (+9%) and Dexus Industrial (+4%) helped performance. Performance was similarly hurt by owning Deterra (-8%) and Woodside (6%). February was a good month for dividends with 7 companies trading ex. The dividend growth in the Income Portfolio was more muted due to the higher weighting to Woodside and Mineral Resources.