Westpac Banking Corporation (WBC) released its first half-year results for 2024, which came in above market expectations. Shareholders were rewarded for their patience with a special dividend and a large on-market buy-back. Westpac is the second of the big four banks to report their half-year results this season, with ANZ tomorrow and CBA reporting their third-quarter results later this week. The HNW Portfolios both hold a 6% weight to WBC.

Key Points:

- Improving Net Profit: Net profit $3.5 billion was down from the first half of 2023 but improved by +5% compared to the second half of 2023. Overall, a good and clean result from WBC with all segments performing well, with mortgages and deposits up 5% and business lending up 9% over the year.

- Flat Net Interest Margin (NIM): WBC’s exit NIM remained flat through the half, benefitting from strong margins in their investment business but lower margins on mortgages due to tightening mortgage competition.

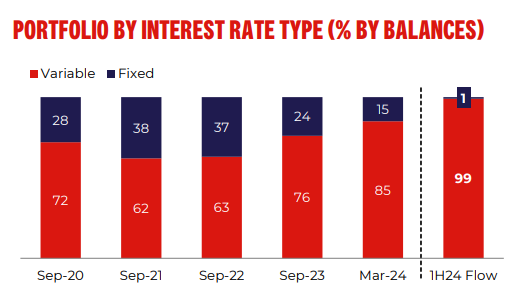

- Bad Debts are still very low: impairment charges 0.09%, down slightly. As expected, WBC has navigated the “fixed interest rate cliff” well, with $146bn of fixed-rate loans having expired or refinanced onto higher rates since 1 October 2021. Currently 85% of WBC’s $495 billion mortgage book is on variable rates.

- Strong Balance Sheet: Westpac currently has a capital ratio of 12.5%, well above its long-term target range of 11.5%, which will see it increase its on-market share buyback from $1.5 billion to $2.5 billion.

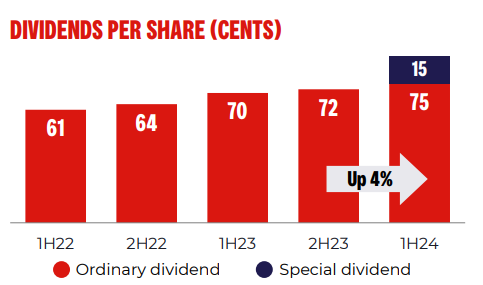

- Show me the Money1: WBC announced a 4% dividend increase to $0.75 per share fully franked and a $0.15 special dividend fully franked thanks to their strong capital position.

- Show me the Money2: WBC revealed an additional $1 billion on-market buy-back. Over the rest of the year, WBC will be buying back $2 billion of their stock on the market.

- Guidance: Westpac did not provide any formal guidance but did cite, due to the better margin outlook, that they are looking to continue to grow their business and institutional lending book. WBC also noted that they are still above the APRA target capital range which could see more capital returned to shareholders later this year if bad debts do not spike. WBC have $3.3 billion in franking credits on their balance sheet.

CEP Strategy: This was a solid result from Westpac, with the business travelling well. We own WBC in the portfolio due to its heavy exposure to mortgages which comprise 63% of WBC’s loan book. Through the cycle, mortgages have historically had much lower bad debt charges than business lending due to Australia’s home loan recourse lending and higher margins. We expect loan losses to remain low or slightly increase going forward, which will offset the more dormant net interest margins. We remain happy holders of the bank, which trades on a PE of 14x with a 5.6% dividend yield.

WBC finished up +2.7% to $27.12.