ANZ Bank (ANZ) released its first half-year results, which came in around market expectations. ANZ is the last of the big four banks to report this season, with CBA to give their third-quarter update on Thursday. Similar to Westpac yesterday, ANZ maintained profit margins in the 2nd half, had negligible bad debts, increased dividends and announced a big buy-back. The HNW Growth and Income Portfolios hold a 6.5% weight to ANZ.

- Flat Net Profit: Net profit of $3.6 billion was down from the first half of 2023 but improved was flat compared to the second half of 2023. The highlight of the result was ANZ’s institutional business, which had the strongest half since 2017 on the back of increased customer activity and keeping expenses flat.

- Net Interest Margin (NIM) Slightly down: ANZ Group NIM remained flat through the half, benefitting from solid margins in their capital portfolios, offsetting lower margins on mortgages that saw increased competition in Australia and New Zealand.

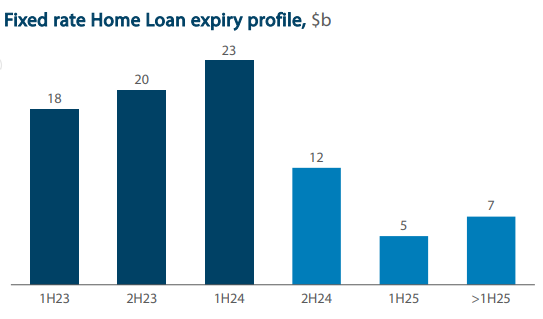

- Lowest Bad Debt Write-Off Ever: Bad debt remains incredibly low at 0.01% of loans. Similarly to the other major banks, ANZ has managed the “fixed interest rate cliff” well, with 92% of their mortgage loans now transitioning to a variable rate (see below).

Atlas see that the low level of bad debts is a combination of the bank’s managing loan book, stronger than expected economic conditions and more conservative lending than we saw from the banks 2000-07. We believe that the loans to developers, property syndicates and troubled industrial companies that went bad in 2008-2010 now sit with the non-bank lenders and private debt funds, rather than the big four banks.

- Suncorp Acquisition: The acquisition of Suncorp remains on schedule, which will provide ANZ with $69 billion or 2.5% more market share in Australian mortgages, as well as $53 billion in deposits and 1.2 million customers.

- Strong Balance Sheet: ANZ currently has a capital ratio of 13.5% or 12.27% after the acquisition of Suncorp Bank, which is well above the APRA minimum capital target requirement of 11.5%.

- Show Me the Money 1: Following the strong capital position, ANZ announced a $2 billion on-market share buy-back, which would reduce total shares outstanding by 2.4% at current prices.

- Show Me the Money 2: ANZ’s dividend increased by 2.5% to $0.83 per share, 65% franked, representing a payout ratio of 73%. This dividend per share is above pre-CV19 levels.

- Guidance: ANZ did not provide any business guidance but noted that the Australian economy and housing is still remaining resilient, which could see more capital released to shareholders with the acquisition of Suncorp proceeding well. We were please to see moderating margin pressure on loans and deposits

CEP Strategy: We own ANZ in the Portfolio on both valuation grounds and the tailwinds the bank will enjoy over the next few years as Suncorp Bank continues to be integrated into the ANZ system and increase ANZ market share as well as rationalising its branch network. ANZ trades on an undemanding PE of 13x and a dividend yield of 5.8%, a significant discount to the wider ASX200. Share buy-backs should prove share price support.

ANZ finished up 2c to $28.79 on what was a solid result. It is surprising that a few weeks ago sell side analysts were calling on investors to sell all of their Australian banks!