Macquarie Group (MQG). On May 5th, the global investment bank reported their full-year results for 2023, which were solid, despite the typically downbeat guidance management gave earlier in the year (see below). The HNW Equity and Income Portfolios both hold a 6% weight to the Vampire Kangaroo.

Key Points:

- Record Profits: Macquarie reported $5.2 billion (+10% YoY) in earnings, driven by a great result from the Commodities and Global Markets side of the business, which grew by 54% to $6 billion in net profit. This growth came primarily on the back of strong risk management income, particularly in Gas and Power, Global Oil and Resources, with MQG profiting from market volatility. Asset Management grew FUM 10% to $871 billion but saw overall profits down on FY22, which included a $577 million gain on selling Macquarie Infrastructure Corporation (MIC).

- Stealing home loan market share from NAB: The banking and Financial Service side of the business reported a 20% profit growth driven by home loan increases to $108 billion (21% YoY) and deposits of $129 billion (32% YoY).

- Dividends up +21% to $7.50 per share = 4.3% yield. This represented a payout of 56% of earnings which is still the low end of Macquarie’s 50-70% payout ratio but allows them to retain their capital to deploy in volatile financial markets. Given the company’s investment record, we are happy to see earnings retained and reinvested.

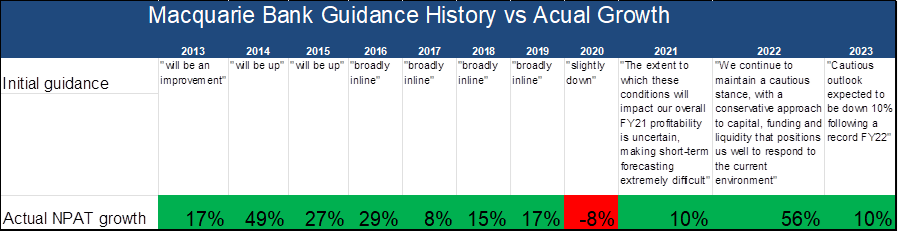

- Guidance: MQG has historically given downbeat guidance citing the challenges rather than the positives, underpromising, and almost always overdelivering (see below table).

CEP Strategy: Atlas’ preferred bank exposure is Macquarie Bank which offers exposure to a global investment bank with a heavy weighting towards stable funds management earnings and will benefit from a falling AUD. Unlike the major trading banks that operate in a competitive oligopoly where any moves to grow market share are swiftly matched by the other banks, Macquarie’s growth is not constrained by Australian GDP growth, with 71% of revenue coming from international markets.

MQG offers investors both the “cake” of stable annuity-style profits from asset management to go with the “icing”, that is, the more volatile earnings that are derived from investment banking and trading in commodities and financial markets.

MQG was flat on the day at $177.35.