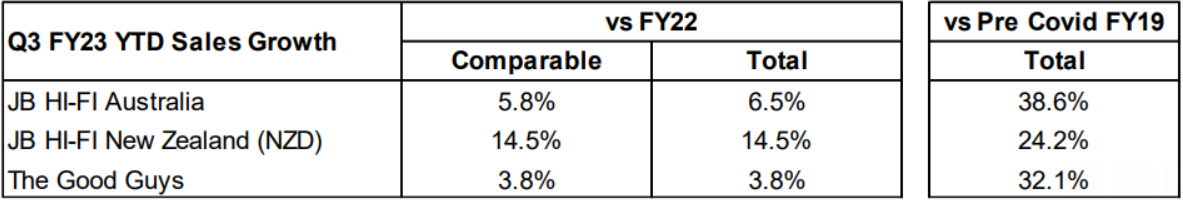

JB Hi-Fi (JBH): Yesterday morning JBH provided an update to Q3 2023 sales which were stronger than expected and defied analyst predictions of a sales slump. The market has consistently underestimated JBH’s ability to pivot into new consumer goods areas. Additionally, like Bunnings in hardware, take advantage of JBH’s position as the lowest cost operator to increase market share. The HNW Equity Portfolio Equity Portfolio currently holds a 2.7% weight in JBH.

Portfolio Strategy: JBH’s business model is based on low prices and low overheads but high volumes. In terms of the cost of doing business (rent, administration and sales staff costs), divided by sales – JBH is one of the most efficient retailers globally, a remarkable outcome given Australia’s high wages and is Australia’s largest electrical retailer and the world’s seventh-largest electrical retailer. More importantly, JBH has consistently recognised declining (CDs) and growing (fitness devices) categories and switched inventory to take advantage of these shifts; the expansion into Home and whitegoods has proved to be very successful. JBH continues to look cheap, trading on a PE of 12x with a 6% fully franked yield. This compares very favourably with HVN’s high single digits sales declines.

JBH finished up +2% to $45.48 (03/05/2023).