ANZ Bank (ANZ) released their first half-year results on May 5th, which came in around market expectations highlighting the increased competition in deposits and lending. ANZ is the second of the big four banks to report this season, with their result being better received than NAB’s the day prior. The HNW Equity and Income Portfolios both hold a 5% weight to ANZ.

Key Points:

- Record Half-year Cash Profit: ANZ reported a $3.8 billion (+23% YoY) half-year cash profit for the financial institution after double digital revenue growth across all of its businesses. All areas of the bank performed well Australian Retail +11% and New Zealand +14% on the back of increased customer deposits and home loans. Institutional was the highlight, with a 35% increase in revenue on payments and currency processing.

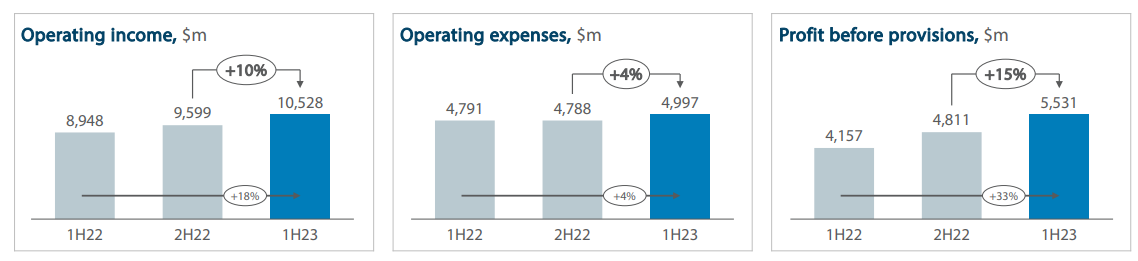

- Positive Jaws: When looking at a bank result, one of the first things to look at is the difference between income growth and expenses. If income is growing faster than expenses, the bank will have a positive Jaws ratio with a chart that looks like the open mouth of a crocodile. Due to the billions in revenue generated by a major bank, this is significant. In 1H23, ANZ’s operating income grew 10%, while expenses only increased by 4%. A great outcome for shareholders.

- Higher Net Interest Margin (NIM): Increased competition on both sides of the book did have an effect on ANZ NIM, but rising rates saw ANZ’s NIM expand from 1.68% to 1.75%. While this sounds quite small when spread across ANZ’s loan book of $690 billion, small increases in margin can generate large profits.

- Dividend now above pre-CV levels: Interim dividend of 81 cents per share (fully franked) up +12.5%, with the bank now paying a higher dividend per share in 2023 than in 2019!

- Guidance: ANZ did not provide formal guidance but cited that lending and deposit competition remain, causing pressure on the NIM and higher wholesale funding costs. Unlike Macquarie, ANZ did cite some tailwinds over the next half of higher capital deposit earnings and the potential for further rate tightening across geographies.

CEP Strategy: We own ANZ in the Portfolio on both valuation grounds and the tailwinds the bank will enjoy over the next few years as the Australian banking oligopoly sees expanding profit margins from both rising rates and rationalising its branch network. ANZ trades on an undemanding PE of 10x with a fully franked yield of 6.7% and will grow earnings per share in 2023 from both rising rates and increased market share with the Suncorp transaction.

ANZ rose 1.5% on the day to $23.80

Positive Jaws