Wesfarmers (WES) presented its full-year 2025 results, which were better than expected, demonstrating that WES’s businesses are performing well and taking market share. WES shares were priced for perfection heading into the results, and that is largely what they delivered, something that rarely occurs. The HNW Portfolios have a 3.6% weight to WES.

Key Points:

- Record Profits: Earnings increased by 14% to $2.9 billion, driven by a 9% increase from Kmart group (Kmart & Target) earnings, following productivity benefits from combining systems and processes. Bunnings’ profits were rock solid, up 4%, and WesCEF (Chemical, Energy, and Fertiliser) and Officeworks posted small decreases in earnings.

- The Growth of Kmart/Anko: Whilst Wesfarmers is renowned for its crown jewel of Bunnings Warehouse, which has 12% profit margins and an impressive 72% annual return on capital. Kmart continues to go from strength to strength, posting 9% earnings increase driven by its Anko brand. Kmart now has 9% profit margins and a 68% return on capital, up considerably from 6% profit margins and a 30% return on capital before the COVID-19 pandemic. Kmart’s profit results of $1,046 million contrast sharply with Woolworths BigW -$65 million loss reported yesterday.

- Balance Sheet: WES has a very strong balance sheet with a net debt position of $4.2 billion, which will be reduced following the sale of Coregas for $770 million, which closed on July 1. Debt/EBITDA is 1.7x below the target range and debt costs a low 3.8%.

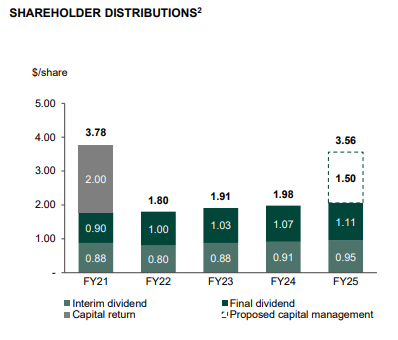

- Dividends Up: Wesfarmers announced a full-year fully franked dividend of $2.06, representing a 4% increase, and continuing its progressive dividend policy (See Below). WES also announced that they will be neutralising their Dividend Reinvestment Plan and purchasing the shares on-market.

- Tax-Effective Capital Return: WES announced that it will distribute a $1.50 special dividend in addition to the full-year dividend. The capital return will comprise a $1.10 capital component and a $0.40 special dividend.

- Guidance: Wesfarmers did not provide any explicit guidance. However, 2026 has started well, with sales growth across all businesses. Shutting down loss-making Catch.com will add an additional $80 million per annum to NPAT.

Portfolio Strategy: WES provides the Portfolio with exposure to a stable, diversified stream of earnings, primarily through the Australian economy, via hardware (Bunnings), office supplies (Officeworks), discount department stores (Target and Kmart), pharmacies (Priceline), chemicals, and lithium. WES is a well-run company, with CEO Rob Scott consistently making sound decisions for shareholders since taking over in 2018. In the Portfolio, we only own the retailers that dominate their markets (Wesfarmers and JB Hi-Fi) and are the lowest-cost operators. This result from WES shows that value-conscious consumers are still happy to open their wallets.

WES finished up +0.5% to $92.06