The Lotteries Corp (TLC), Australia’s largest lottery operator, released full year results for 2024 this morning, demonstrating that the house (and investors in TLC) always wins. The HNW Portfolios have a 3% weight to TLC.

Key Points:

- Profits Up Strongly: TLC earnings up +21% to $412 million, an excellent year for the company, though aided by favourable jackpots with the record $200 million Powerball jackpot generating queues in retail outlets and saw TLC add another 500K registered customers. High jackpots stimulate interest in lotteries (the $200M Powerball draw on 1st February is the equivalent of 1 in every 2 adult Australians buying a ticket) but reduce TLC’s interest costs as they hold onto the jackpots until they are paid. We were pleased to see continued growth in the digital channel, up +18% or $470 million – this is a higher margin business for TLC and avoids paying away commissions to newsagents.

- Weekday Windfall: Weekday windfall is the next step for weekday lotteries, which will see all the state brands (see below) for Monday and Wednesday lotteries move under the same name, providing TLC more operating leverage. This was launched in May 2024 and adds an additional $135M in annualised turnover.

- Dividend: TLC announced a dividend of 16 cents per share plus a special dividend of 2.5 cents fully franked.

- Balance Sheet: remains robust with a leverage ratio of 2.6 times below the target range of 3-4x EBITDA.

- Guidance: No explicit guidance was given, though TLC has proven through the cycle to be a very stable and growing cash-generative monopoly business.

TLC finished down -1.8% to $4.83.

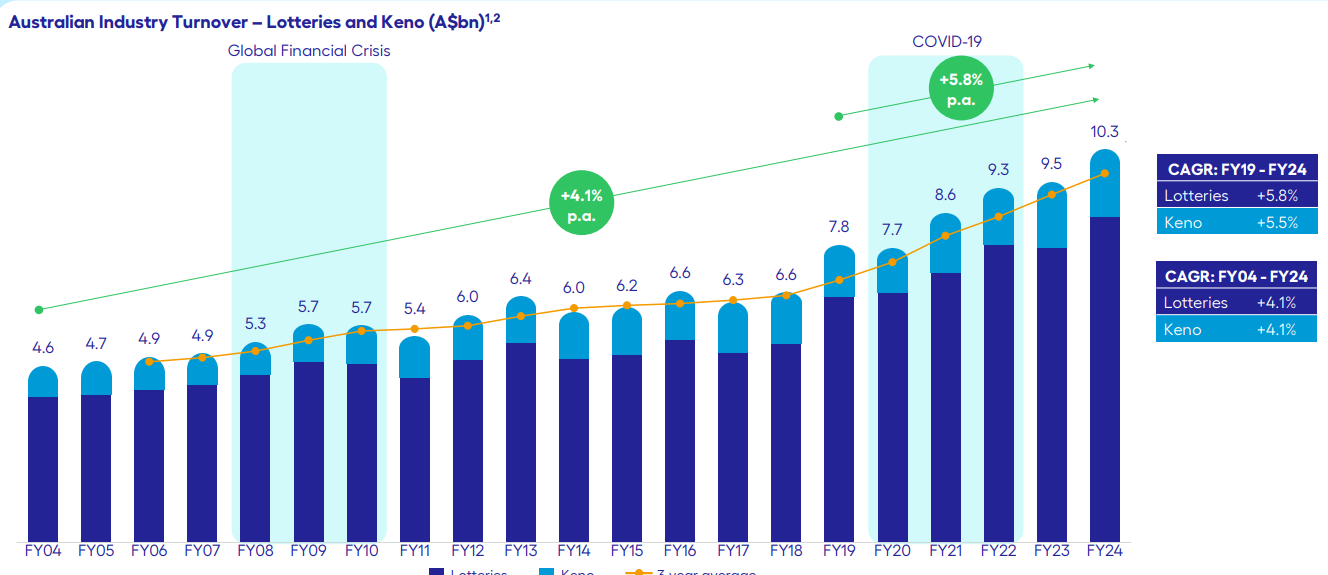

Portfolio Strategy: TLC, Australia’s most stable gaming company, holds the monopoly licence to run lotteries in all Australian states except WA. TLC’s lotteries business with long-duration licences (average expiry 2042) gives investors stable and defensive earnings, which would be very attractive as a potential takeover target. Increasing digital penetration of lotteries and keno played on smartphones increases TLC’s profit margin as the revenue leakage to newsagents and clubs is reduced.

The Portfolio’s move to favour the more “boring” and mechanical end of the gambling industry instead of casinos looks to be a good move, with Star Casino and Endeavour (poker machines) facing increased regulatory risk and fines. The pie chart on the left shows the simplicity and transparency of TLC’s business model, which effectively guarantees a profit margin on each dollar invested in a lottery ticket, along with how heavily the government wets their beak in the lottery industry and why the state is incentivised to protect TLC’s monopoly business against synthetic US lotteries.