Deterra Royalties (DRR): Australia’s only iron ore royalty trust and the most boring miner on the ASX released their full year 2023. For DRR, there is minimal scope for surprises on results day as revenue and production data were pre-released, and the company is a royalty trust that passes through payments from BHP with a 95% profit margin. The HNW Growth holds a 2% and the Income a 3% weight in DRR.

Key Points:

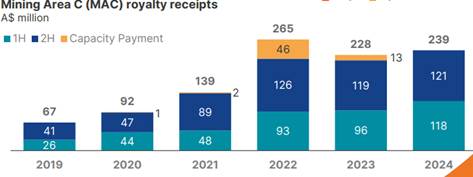

- Second Most Mining Sales: Deterra recorded $241 million in revenue for the year, representing a 5% increase on last year. The most impressive part was that the Deterra could do this without a capacity increase payment. (See Below)

- Trident Acquisition: Deterra is looking to acquire Trident Royalties in the coming quarter for A$276 million which will diversify DRR away from solely an iron ore in Australia to a global lithium, iron ore and gold royalty. The acquisition will add 21 more royalties to Deterra, with more than 60% of the assets located in Australia, Canada and the US. Ther royalties are a mix of gold, silver, copper and lithium.

- Benefits of a Royalty Trust: Deterra provides investment in iron ore, soon-to-be gold and lithium without having to take on the underlying operating risks, allowing for high margins that are protected from inflation.

- Dividends: Deterra announced a full-year, fully-franked dividend of 29.29 cents per share, representing a 100% payout ratio of earnings and a 2% increase on last year

- Outlook: Deterra management did not provide any explicit guidance, but they did reiterate that they are looking forward to the integration with Trident Royalties and are also evaluating other M&A opportunities in the market. Given how poorly DRR management have presented the Trident acquisition to the market, we are not sure that M&A should be top of management’s agenda.

Portfolio Strategy: DRR is a royalty trust that owns an income stream based on 1.23% of the revenue BHP receives from iron ore mined in the Mining Area C iron ore tenements. Based on current production, the mine life of these assets currently stands at 30 years. As a royalty trust, DRR is not responsible for operating the mine, raising wages, any capital expenditure or clean-up costs, which is an attractive proposition in our opinion. DRR’s assets are low-cost and it trades at a discount to other royalty trusts.

DRR finished up 2.5% to $3.77.