The Lotteries Corp (TLC), Australia’s largest lottery operator, released their half-year results for 2024 this morning, demonstrating that the house (and investors in TLC) always wins. The Atlas Growth Portfolio has a 3% weight and the Income a 3.5% weight to TLC.

Key Points:

- Profits Down: TLC earnings decreased by -6% to $217 million, driven by poor timing for a large Mid-Year Megadraw and increased IT and cyber spending. Revenue was down slightly by -2%, demonstrating that consumers are happy to keep playing lotteries and keno despite rising cost of living pressures.

- Weekday Windfall: Weekday windfall is the next step for weekday lotteries, which will see all the state brands (see below) for Monday and Wednesday lotteries move under the same name, providing TLC more operating leverage. In conjunction with this, TLC announced they will also do a Friday lottery under the Weekday Windfall brand, bringing it to three weekday lotteries which will increase revenue.

- Dividend: TLC announced a dividend of 8 cents per share, representing a payout ratio of 91%, at the mid-point of the target range of 80-100% of net profits.

- Balance Sheet: remains robust with a leverage ratio of 3 times at the lower end of the target range with an average debt term of 5.5 years and 80% hedged.

- Guidance: No explicit guidance was given, though TLC has proven through the cycle to be a very stable and cash-generative monopoly business. Powerballs worth $100 million, $150 million and $200 million in February 2024 were not captured in this result, which is something we look forward to, with one in every two Australians buying a lottery ticket in the last two draws.

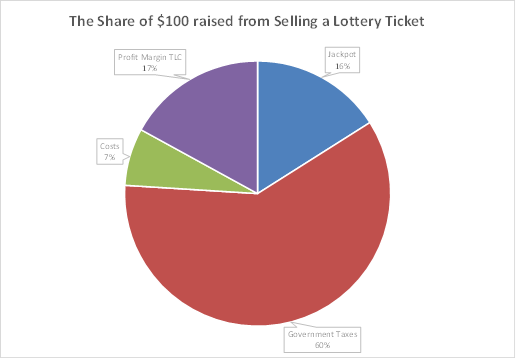

Portfolio Strategy: TLC is Australia’s most stable gaming company and holds the monopoly licence to run lotteries in all Australian states except for WA. TLC’s lotteries business with long-duration licences (average expiry 2042) gives investors stable and defensive earnings, which would be very attractive as a potential takeover target. Increasing digital penetration of lotteries and keno played on smartphones increases TLC’s profit margin as the revenue leakage to newsagents, and clubs is reduced. Additionally, the high % of government taxes creates an incentive for the state to prevent competition.

The Portfolio’s move to favour the more “boring” and mechanical end of the gambling industry instead of casinos looks to be a good move, with Star Casino down -64% and Endeavour (poker machines) down -21% over the past year due to increased regulatory risk and fines. The pie chart on the left shows the simplicity and transparency of TLC’s business model, which effectively guarantees a profit margin on each dollar invested in a lottery ticket, along with how heavily the government wets their beak in the lottery industry!

TLC finished +2% to $5.15