Mineral Resources (MIN): This morning, the diversified miner and mining services company reported their first half of 2024 results, which were far better than lithium competitors and showed the advantage of MIN’s diversified strategy. The HNW Equity Portfolio holds a 2.5% and the Income 3.5% weight to MIN.

Key Points:

- Profits Down: Revenue is up 7% but profits are down -50 % to $196 million, driven primarily by the retreat of lithium spodumene, battery chemical prices, and higher interest costs from expansion projects. Mining Services revenue increased by 22% due to 5 new mining contracts with tier 1 clients, and iron ore revenue increased by 36% due to an increase in the iron ore price.

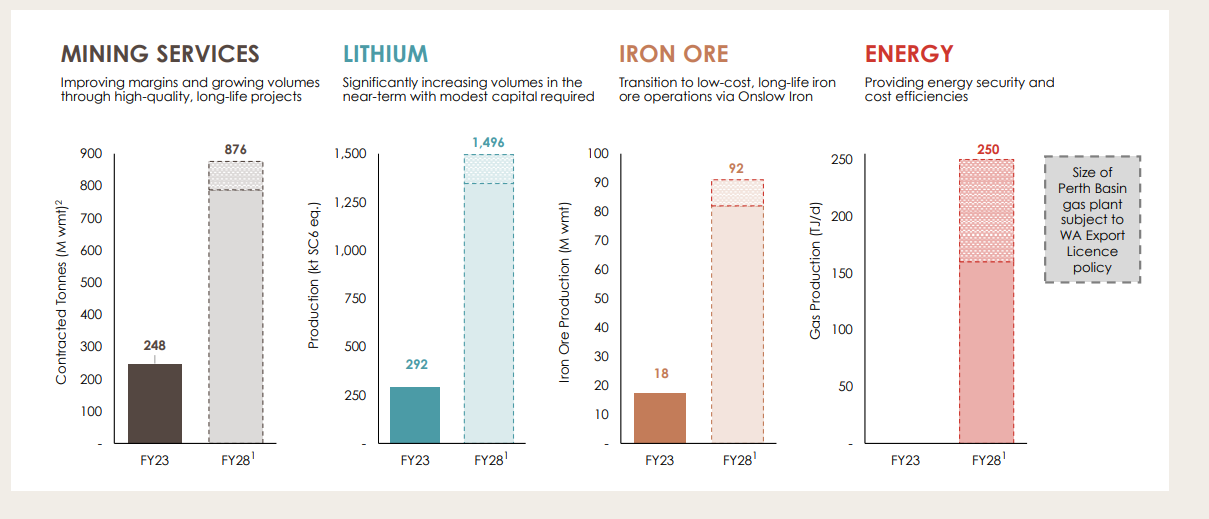

- Across the Portfolio: Mining Services earnings remained steady throughout the half, although lithium earnings were lower due to pricing. Both Lithium mines were able to increase production by over 33%. The iron ore business is performing well, with steady production and lower costs per tonne to come once the Onslow Iron is fully operational.

- Dividends Down: MIN announced a dividend of $0.20 per share, representing a very low payout ratio of 20%, as MIN focuses on paying down its debt from recent expansions.

- Balance Sheet: MIN’s balance sheet was the only area of concern on the analyst call, though we are pretty relaxed as the increase in gearing is not due to a deterioration in MIN’s business but rather due to expansions in lithium and iron ore with the company spending $1.7 billion in 2023 to improve its operations. This has allowed MIN to produce lithium spod at a much lower cost base (~US$440/t vs spot > $600/t) than last year. MIN has no debt due until 2027 and has a five times interest cover, so the banking wolves are not howling at their door.

- Guidance: MIN reaffirmed its FY24 guidance across iron ore and mining services, with the lithium business guiding to lower costs across the next half but higher capital expenditure for deferred stripping.

- Why is the stock up? Expansion projects in iron ore and lithium are on track and on budget, a pleasant surprise in Western Australia, and additional earnings streams from iron ore and mining services put MIN in a better position than lithium competitors.

CEP Strategy: MIN is a diversified miner and mining services with four main business segments: mining services, lithium, iron ore and gas. Lithium is the jewel in MIN’s crown, with the company now the world’s 5th largest lithium miner with two operating Tier 1 hard rock mines in Western Australia as well as downstream processing. The company has a unique business model of owning assets and providing mining services to its own and external clients. This gives investors a per-tonne annuity income stream that is not correlated with commodity prices.

MIN finished up +3% to $61