This morning, global pathology company SHL provided a trading update for their full-year results, which were below market expectations due to higher inflation and currency headwinds. The HNW Equity Portfolio has a 2.5% weight to Sonic.

Key Points:

- Inflation & Currency Bites: SHL provided updated guidance of A$1.6 billion in earnings, slightly outside the range of the guidance provided in February of $1.7-$1.8 billion. This was driven by inflationary pressures on margins (wages & consumables) as well as currency headwinds, with the Australian Dollar appreciating in recent months. Management said that inflation had reduced in key markets had moderated and that they have taken some headcount out of the business taken on to service the rivers of Covid-testing gold.

- Growth: Sonic still expects organic top-line revenue growth of 6%, with some benefit coming through from four acquisitions it has made over the past six months.

- Strong Balance Sheet: SHL remains in a strong financial position, with low levels of debt and tailwinds for the essential services it provides to an increasing population of aging and sick people. The synergies between the acquisitions will be seen over the next two years as they become fully integrated into Sonic.

- Guidance FY25: Earnings are expected to increase to $1.70- 1.75 billion based on organic growth and recent acquisitions in the USA, Switzerland and Germany.

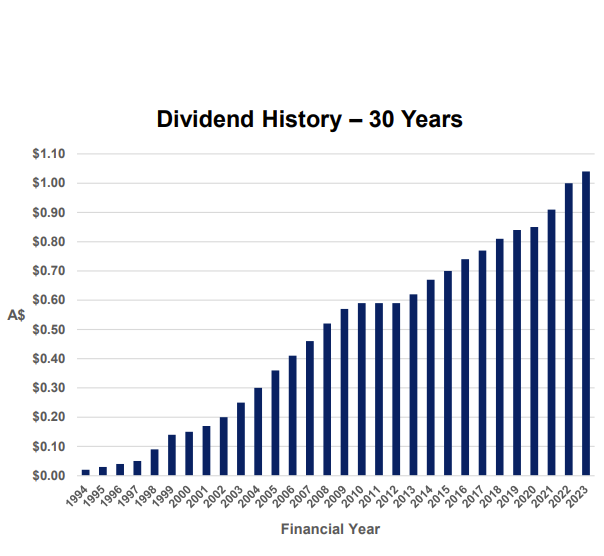

- Share Price Mismatch: SHL trades at a discount on its share price in May 2019, however since then SHL has increased earnings by 60% (or A$600 million), reduced debt and improved the quality of the business. SHL trades on a forward PE of 17x with a dividned yield of 4%.

Portfolio Strategy: Sonic and CSL represent the core healthcare positions in the Portfolio. SHL exposes us to rising demand for medical testing, exacerbated by new medical technologies, an aging population and a desire by doctors to cover themselves against malpractice claims by increasing the number of tests being ordered. SHL is one of the largest global patient testing companies with a significant market share in Australia, Germany, the UK and the USA and will benefit from a falling AUD. Unlike drug companies or device companies such as Cochlear, SHL has an industrial process of blood and tissue sample testing that benefits from economies of scale and not the hundreds of millions of dollars invested in R&D to develop the next wonder drug device.

In the medium term, SHL will benefit from an older and sicker population, and doctors will schedule more tests to avoid malpractice suits, particularly in the USA, where SHL is now the third largest pathology company. Unlike many companies splashing around AI this reporting season with often dubious connections to their business, SHL is likely to see significant benefits from digital pathology and AI. The company has made substantial investments in this area in the past two years, starting with a prognostic AI algorithm for melanoma.

SHL was down by 6% to finish at $25.01. We will be looking at adding to this high-quality company’s position with an excellent long-term record of generating profits and increasing dividends.