Lendlease (LLC), the multinational construction and asset management company, had a strategy day today, which was well received by the market, with management presenting plans to simplify the business and improve profitability. This was done in response to pressure from unhappy shareholders. The HNW Equity Portfolio has a 2% weight to LLC.

Atlas were interviewed by the ABC today on Lend Lease https://www.abc.net.au/news/programs/the-business/2024-05-27/investors-force-lendlease-to-pull-out-of/103899752

Key Points:

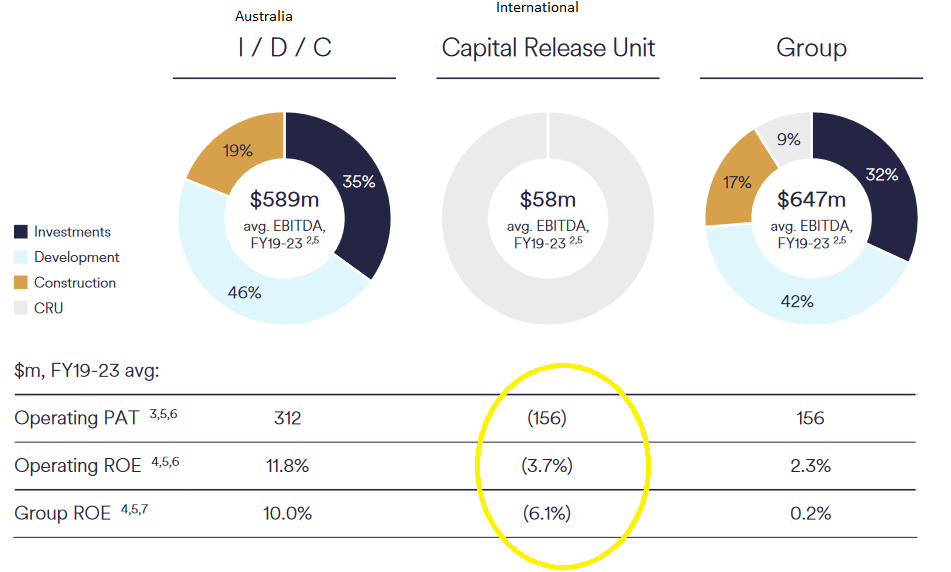

- Addition via Subtraction: the key move announced today was that LLC will divest/wind down their offshore business, which was revealed to have a profit margin of just 0.6% FY19-23 and, in aggregate, lost $156M over this period, which was alarming. Historically LLC did not give the financial results for their international business, just mixing it with their Australian business. This suggests that prestigious developments in the USA and Europe distracted management and were profitless growth. No new projects will be started, and the $4.5B in capital deployed offshore will be repatriated to Australia as projects are completed. Thankfully, last year LLC pulled out of a deal to develop $23B in commercial property assets for Google in San Fransisco.

- Retreat to Australia: Australia historically more profitable, a familiar refrain for Australian companies thinking that their expertise in Australia will easily translate into global domination – the banks, IAG, and Bunnings in the UK. The list is long. The data released by LLC shows that Investment and Development (Australia) are the profitable business units – construction and International a drag on earnings over the past 5 years. Yet another Australian company thinking that their brilliance in their home markets will translate to global dominance.

- What’s Left: 1) a very profitable funds management business with $50B in FUM 2) an Australian development arm with a $13B pipeline, and a historical ROIC of 18% and 3) Australian construction business with about $3.4B in revenue and an EBITDA margin of 3.3%.

- Return of Capital: LLC announced an initial $500M on-market buy-back, with a $2.8 bn capital release by FY25, this equates to $3.42 NTA per share. The initial buy back will be funded from the A$1.3 billion communities’ sale to Stockland and the sale of 21% of the US military housing business for $126 million

Lendlease finished up +8% to $6.36.