Woodside (WDS), Australia’s largest oil and gas company, announced yesterday morning that it had approved development of its Trion oil field 180km off the north-east coast of Mexico. The HNW Portfolios have a 7% weight to WDS.

Key Points:

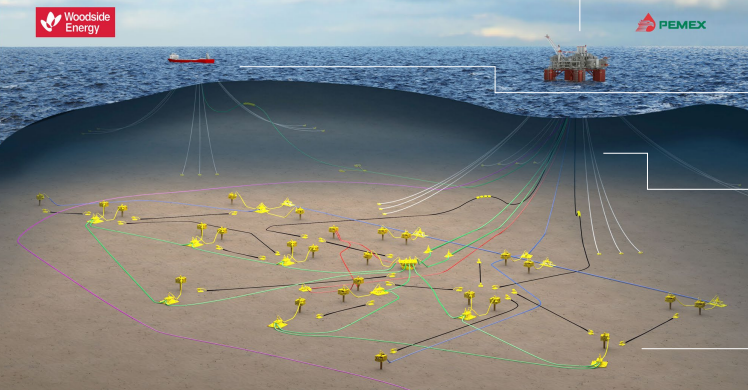

- Increased Production: The Trion project cost is expected to be US$7.2 billion with (WDS’s share US$4.8 billion) and involve an initial 19 wells with a forecasted oil production capacity of 100,000 barrels per day (see below). The 479 million barrel of oil field is highly productive with a 16% IRR with an expected payback period of less than 4 years.

- Woodside will be the operator of the project with a 60% participating interest with PEMEX (Mexico’s nation oil company) holding the remaining 40%. First oil is being targeted for 2028 with two-thirds of the oil in the field to be produced with 10 years = fast payback. Woodside later came to have the asset after their merger with BHP Petroleum in June 2022.

- How did this happen? Thanks BHP & ESG Investing Screens! This project has only become possible through the merger with BHP Petroleum, not only for access to the field but through the larger free cash flow that Woodside has now to fund the project. If this project was to be done 2 years ago, Woodside would have either had to sell an equity interest in the field or conduct a dilutive equity raising. Currently WDS is debt free and cashed up.

Portfolio Strategy: WDS is the Portfolio’s sole energy exposure and is the most conservative and well-managed Australian oil company. WDS has the lowest production cost and gearing, an essential position for an energy company as conditions are not always as sunny as they currently are. Atlas prefers WDS over Origin and Santos, as WDS has minimal exposure to the East Coast gas market, where politicians are floating legislation requiring these LNG producers to break long-term 20-year export contracts with Asian utilities to reserve gas for the domestic market, which faces supply constraints due to moratoriums on new gas projects in NSW and Victoria. WDS trades on a PE of 11% with a 7% yield.

WDS gained 2.2% to finish at $36.31 (20/06/2023)