CSL: This morning, a world’s leader in manufacturing medicines from human blood, gave a trading update that came in below market expectations as continued strength in the USD impacted the translation of foreign earnings. The HNW Equity Portfolio holds an 8.5% weight to CSL, but a zero weight in the Income Portfolios.

Key Points:

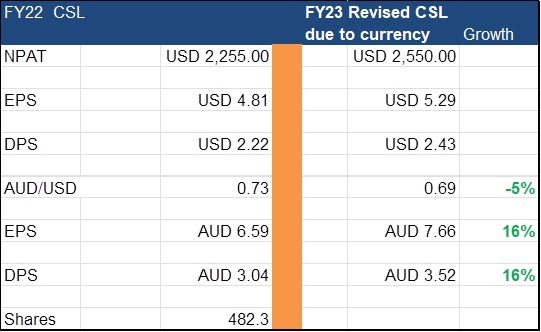

- Strong US Dollar: Currency translation has negatively weighed on FY23 reported earnings by approximately US$250M up from US$175M at the February results, primarily driven by the conversion of weaker Euro and the Chinese Yuan profits into USD.

- Positive FY24 Guidance: In this update, CSL provided guidance for its earnings in FY24, projecting sound earnings growth for the next year of between +13-18%, representing between US$2.88 billion and US$3 billion.

- Underlying Business Cost Cutting: The underlying business is still performing well this year, with its Behring business being able to lower its plasma costs by 15-20% from its peaks last year as worsening economic conditions and rising inflation encourage donors to sell their blood plasma to CSL.

- What does this mean for Australian investors? Not much. While a stronger USD is negative for reporting in US Dollars, it is positive for CSL’s Australian investors and one of the reasons we like the stock. While CSL shifted down guidance in USD, for Australian investors, earnings and dividends per share will be up +16%.

Portfolio Strategy: CSL is a world leader in manufacturing medicines from human blood and flu vaccines as well as medicines to treat iron deficiencies and chronic kidney disease. The business enjoys substantial barriers to entry with stable margins and in Australia enjoys exclusive rights to the production of blood plasma-derived medicines. The company earns over 90% of its profits offshore and benefits from a falling AUD. Key catalysts over the next 12 months will be news around the clinical trials of CSL 112, a new treatment aimed at preventing secondary heart attacks, if CSL 112 is approved, this is expected to add ~ $450 million annually to CSL’s profits. While disappointed at the price reaction today, nothing in this update has changed our investment thesis.

CSL fell -6.8% to $287.25 in what looks like an overreaction on behalf of Australian investors that will still see a 16% growth in earnings and dividends through currency translation. On further weakness, we will look to add to the position.