This morning Suncorp (SUN), the Queensland based insurer and bank operator, delivered a strong result continuing its performance from the first half of the year. The HNW Portfolios have a 2.5% weight to SUN.

Key Points:

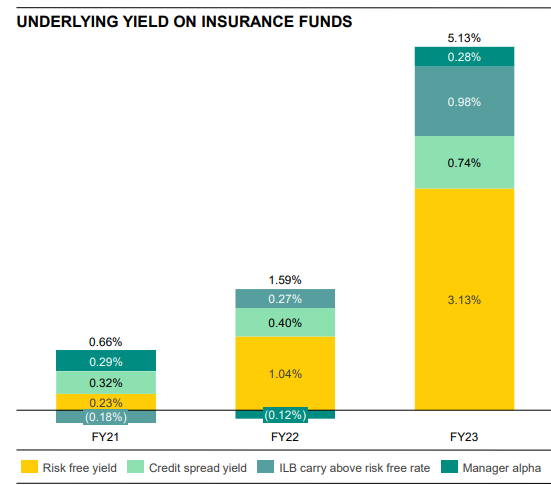

- Record Profits: 2023 proved to be a record year for SUN with net profits up +69% to $1.15 billion. Outside of New Zealand the business is firing on all cylinders, insurance Australia saw 300% increase in profit driving by a perfect storm of higher premiums and a massive increase in fixed rate returns on their investment float (see below). In the past 2 years SUN has gone from earning 0.66% to 5.13% on their $14 billion insurance “float”. We were very pleased with the Suncorp Bank performance which delivered $470 million in profit, up 28%, driven by strong volume growth and higher margins. Suncorp bank was able to push out its margin to 1.96%, higher than other regional banks in Australia. An outstanding result for a bank that is halfway out the door. New Zealand was weaker due to higher expenses caused by the flooding in New Zealand earlier this year.

- Bank sale delay will cost Suncorp an extra $100 million in fees taking it to an estimated total of $600 million for the separation. Both Suncorp as well as Atlas take the view that the sale will eventuate in the middle of 2024 as they begin their appeal to the Australian Competition Tribunal later this year.

- Increased dividends: Suncorp’s board approved a ordinary fully franked full year dividend of $0.60, representing an increase of 50% on the last years dividend.

- Outlook: The insurance arm of the business looks like it will continue to do well with management giving guidance on written premium increasing by 10% and insurance margins to remain between 10-12%, whilst the bank’s net interest margin looks to remain competitive around 1.9%.

- Why is the stock down? The stock was down due to the parsimonious dividend payout ratio of only 60% – the low end of managements target payout ratio of 60-80%. Management categorised the low payout ratio as prudent given the uncertainty around the sale of its banking arm.

CEP Strategy: SUN is a diversified insurance and banking group, but soon to be a pure domestic insurer. We are attracted to SUN as it gives the portfolio exposure to rising insurance premiums across Eastern Australia as well as higher interest rates. We have preferred SUN over IAG as our domestic insurance exposure as it is much cheaper, and we like the potential for further capital returns. SUN trades on a PE of 13x with a 5% yield

SUN finished down 1.5% to $13.54 – however Suncorp has been great performer in the portfolio gaining +23% to the portfolio over the last year vs ASX 200 +8%.