Commonwealth Bank (CBA): reported their full-year results for the 2023 financial year, which were very solid, as expected. Due to the breadth of its lending activities touching every sector, CBA is watched very closely for a read on the broader Australian economy’s health. Additionally, CBA’s result was going to be the first banking result to show the impact of the “fixed rate cliff”. The HNW Portfolios have an 8.5% weight to CBA.

Key Points:

- Record Profits: Cash profit was up +6% to a record $10.1 billion and slightly ahead of expectations despite increasing provisions by $500 million over the past half, which cynics would say was done to reduce the headline profit; not that it helped see Corporate earnings’ obscene’ as CBA posts record profit, say Greens . Going into this result, many were expecting CBA to show signs of weakness; higher bad debts and stressed loans, increased expenses, and lower profits; but it was hard to detect much in the way of issues in this result. Across the bank’s businesses, the powerhouse retail bank was solid, as expected. Still, for us, the highlight was the business bank that contributed an additional $970M in profits due to increased lending and lower costs. This suggests that CBA has taken market share. ROE remains the best of the Aussie banks at 14%.

- Net Interest Margins: As expected, the bank’s net interest margins increased by 0.17% to 2.07% despite high competition in the mortgage and deposit markets. Here CBA benefited from a perfect storm of repricing loan rates upwards and not much movement on funding costs, with 75% of the loan book funded by customer deposits and low loan losses. This might not sound like much of an increase, but when applied over CBA’s $933 billion loan book, small increases make a big difference. CBA revealed that they still had $110 billion in zero-interest deposits!!!!!

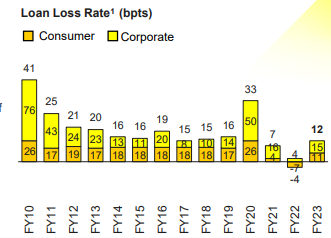

- Bad Debts still low: and comprise only 0.12% of gross loans, well below the long-term 0.30% average (see below table). While far less pessimistic than the markets, Atlas was expecting a bigger increase in bad debts.

- Dividend Up: +17% to $4.50 which was higher than expected, with CBA now the first Aust bank to pay a per share dividend above its pre-CV levels. The DRP will be neutralised and will see approximately $800 million worth of shares repurchased on-market.

- New Buy-Back announced: $1 billion of shares to be repurchased on the market over the next few months. With changes to the rules around off-market buy-backs, CBA management will look at fully franked special dividends in the future to return excess capital to shareholders.

- Why is the stock up? A combination of a surprise share buy-back, lower bad debts and interest margin holding up well which will see earnings upgrades for FY24.

Portfolio Strategy: Our positive investment view towards Australia’s premier retail bank has not changed, though, in fairness, this result was better than we expected. What to do with the banks in 2023 has been a key question for investors, with bank shares very volatile as investor emotions swing from euphoria to despair. This result showed the resilience of the CBA’s key profit centre retail banking services, as high employment and a cleaner corporate loan book than in 1991 or 2007 will see lower bad debts (and higher profits) than the market expects. CBA is a well-capitalised Australian bank with a Tier 1 ratio of 12% post the 1H23 dividend and a $1 billion buy-back.

Commonwealth Bank finished up +2.6% to $104.85