Janus Henderson (JHG) This morning, the global fund manager presented their third quarter 2023 results, which were better than expectations, but the big news was plans to delist from the ASX and focus on the NYSE. The HNW Equity and Income Portfolios both hold a 2.5% weight to JHG.

Key Points

- Revenue Up: Quarterly net profit after tax +4.6% to US$107M driven by higher management fees and lower expenses.

- FUM: Funds under management of US$308.3 billion, increasing +12% over last year. During the quarter, JHG saw a 4% decline in FUM, which was better than expected and mainly due to market movement.

- Dividends: Quarterly dividend flat at US$0.39 = A$ 61 cents, ex-date 10/11

- Strong balance sheet: JHG has a net cash position of US$ 1 billion, so unlike many heavily geared companies, higher interest rates have had zero impact on JHG’s earnings.

- Share Buyback: Management announced that they will be undertaking an on-market share buyback program of US$150 million, which is set to be completed before Janus Henderson’s AGM in March 2024.

- Why is the stock up? A solid result from JHG and

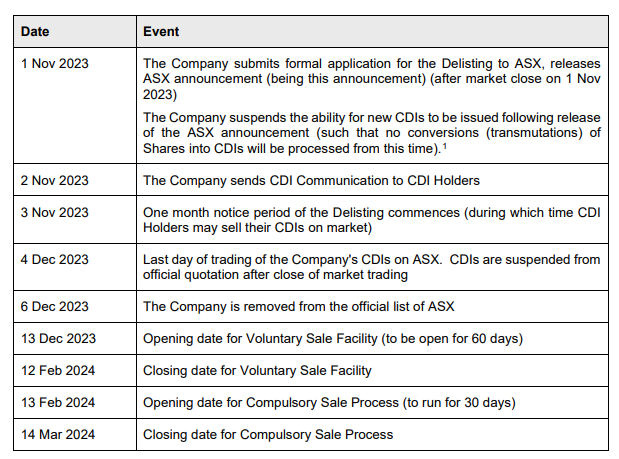

- Why delisting (1): Janus Henderson announced that it had submitted a formal request to delist from the ASX. The company is looking to delist from the ASX because the issued capital being held in Chess Depository Interests (CDIs) on the ASX has declined to 5.5% as of September 2023 from 44% at the peak in January 2018. This is due to a combination of share buybacks on the ASX and US-based investors buying on the ASX and switching the CDIs into US-listed shares. Additionally, the low volume traded of CDIs on the ASX has seen JHG drop out of the ASX 200 despite solid operational performance.

- Why delisting (2): JHG is not an Australian company. It reports in USD, with a head office in the UK, has a main business focus on the USA and Europe, with negligible operations in Australia. The ASX listing is a quirk of fate with UK-based Henderson was acquired by AMP in 1998 as part of their quest for global domination and spun off to AMP shareholders on the ASX in 2005.

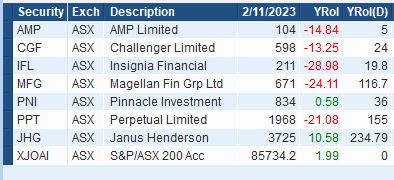

CEP Strategy: Atlas will look to exit the position close to delisting dates (see below) as we cannot hold US-listed stocks in our investment mandate. This is not the outcome we were expecting with Trian at 19.3% of JHG, but the company is in good shape and has been the top-performing ASX-listed fund manager over the past year.

JHG finished up +2.5% to $37.25 after reporting third-quarter results and announcing that they will be delisted from the ASX.