Deterra Royalties (DRR): Australia’s only iron ore royalty trust and the most boring miner on the ASX announced this morning that have offered to acquire Trident Royalties, a diversified royalty trust based in the UK. The HNW Portfolios currently have a 2.5% weighting to Deterra.

Key Points:

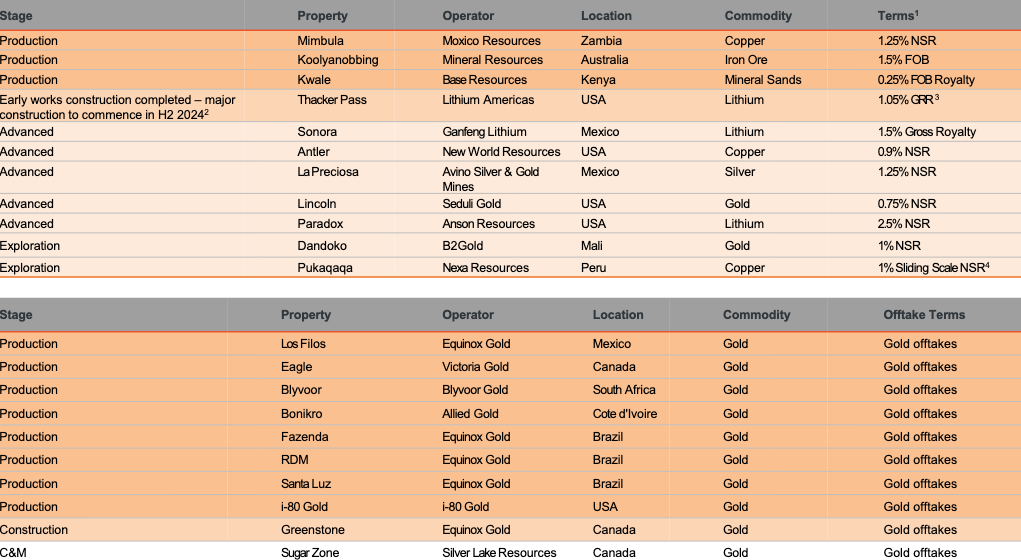

- The Deal: DRR is looking to acquire all of Trident Royalties for A$276 million or £0.49 cash per share. Trident is a diversified miner royalties trust listed in London that has 21 royalties and royalty-like offtake agreements, with 41% exposure to lithium, 32% exposure to gold, 19% exposure to copper, 6% exposure to silver and 2% exposure to mineral sands (see below table)

- Acquisition makes sense This will diversify DRR’s assets across North America, South America, Africa, and Australia. These assets are similar to DRR’s current royalty trust in that there is no operational risk surrounding capital expenditure or rising wages, but rather revenue or physical gold offtakes.

- Deterra is planning to fund the acquisition through an A$500 million undrawn funding facility. Prior to this transaction DRR was debt free.

- Why is the stock off? Due to this acquisition, DRR plans to reduce its dividend payout ratio from 100% of profit to a minimum of 50% of profits so that debt can be retired early. From our calculations the cashflows from the Trident assets alone will pay this debt in 5.5 years, when combined with 50% of DRR’s iron ore cash flows the debt will be paid off in 2 years and DRR will have a 20% uplift in earnings. Similar to Whitehaven Coal we are happy to take some short term pain in the form of a reduced dividend to improve the quality of our investment.

Portfolio Strategy: DRR is a royalty trust that owns an income stream based on 1.23% of the revenue BHP receives from iron ore mined in the Mining Area C iron ore tenements. Based on current production, the mine life of these assets currently stands at 30 years. As a royalty trust, DRR is not responsible for operating the mine, raising wages, any capital expenditure or clean-up costs, which is an attractive proposition in our opinion. DRR’s assets are low cost. Overall we like this acquisition as it diversifies DRR’s royalty exposure.

DRR finished down -2% to $4.06