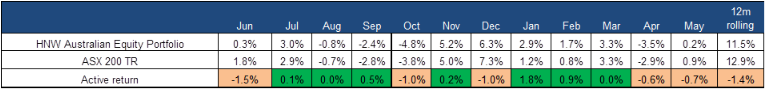

In May, the HNW Australian Equity Portfolio posted a slight +0.23% gain trailing of the ASX200 TR +0.92%. The two main themes were excitement around artificial intelligence (AI) and tech stocks, along with BHP trying to make the largest and potentially the worst takeover in Australian history with their offer of A$75 billion for miner Anglo American. The investor excitement around AI looks very similar to the enthusiasm around the “dot com” boom seen in 1999/2000, with many unlikely companies making tenuous claims that they are tech/AI companies such as RioTinto and Fortescue Metals. BHP’s pursuit of the South African miner seemed to be a worse version of Rio Tinto’s 2007 acquisition of Canada’s Alcan, and was rejected by Anglo’s despite increasing the price twice.

Over the month, positions in Amcor (+9%), Incitec Pivot (+6%), Medibank (+4%), Whitehaven (+4%), along with the banks (all between 3% and 4%) added value. On the negative side, the ledger performance was hurt by Ampol (-6%), Bapcor (-26%), Sonic (-9%), and Suncorp (-4%).

Furthermore, not owning BHP (+3.5%) hurt performance as the giant miner rallied on the news that they were walking away from buying Anglo, though June has seen most of BHP’s gains evaporate on weakness in the iron ore price & Baporp has rallied on a takeover offer.

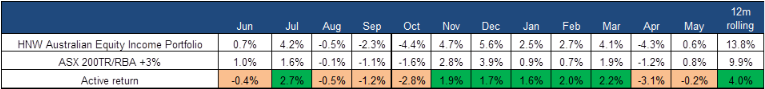

May was a solid month for dividends, with Amcor, Macquarie, ANZ and Westpac all declaring dividends.

The HNW Equity Income Portfolio had a slightly better month up +0.6%. Over the month, positions in Amcor (+9%), Incitec Pivot (+6%), Medibank Private (+4%) and Commonwealth Bank (+4%) added value, with not owning Whitehaven compared to the Growth portfolio offsetting not owning Bapcorp and Sonic