This morning, Whitehaven Coal (WHC) released its full-year results for 2025, which were largely in line with market expectations, given that it provided a trading update in late July. The HNW Portfolio currently holds a 3% weight in WHC.

Key Points:

- Profits Down: Whitehaven recorded a fall in profits to $319 million, driven primarily by a fall in the price of metallurgical coal (-32%) and thermal costs (-11%). While coal prices were subdued, WHC demonstrated operational excellence across its portfolio, pulling out over $100 million in savings from the gold-plated BHP Queensland operations.

- Blackwater Sell-Down: The June quarter marks the first quarter of the change in ownership structure for Blackwater, with WHC selling 30% to JFE Steel and Nippon Steel for US$1.1 billion. During the June quarter, Blackwater set a coal production record, with the mine increasing production by 27% to 2.8 million tonnes for the quarter.

- Strong Balance Sheet: WHC currently has A$600 million in net debt, representing a gearing ratio of 10%, and a leverage ratio of 0.5x. This provides WHC with plenty of flexibility in the balance sheet to continue focusing on operational excellence. With the change to a primarily metallurgical rather than thermal coal company, WHC has seen its interest costs decrease and is now willing to hold some debt.

- Dividend Down: WHC announced a full-year fully franked dividend of 15 cents per share, representing a payout ratio of 60%. This is at the top end of the new capital management framework, targeting dividend payout ratios of between 40% and 60% of underlying profits.

- On-Market Share Buyback: WHC management announced that their $75 million share buyback will continue into FY26, with $48 million still to be bought back before the end of the calendar year.

- Guidance: WHC management provided guidance that they expect to produce 39 million tonnes of coal next year, with a group cost of A$137 per tonne.

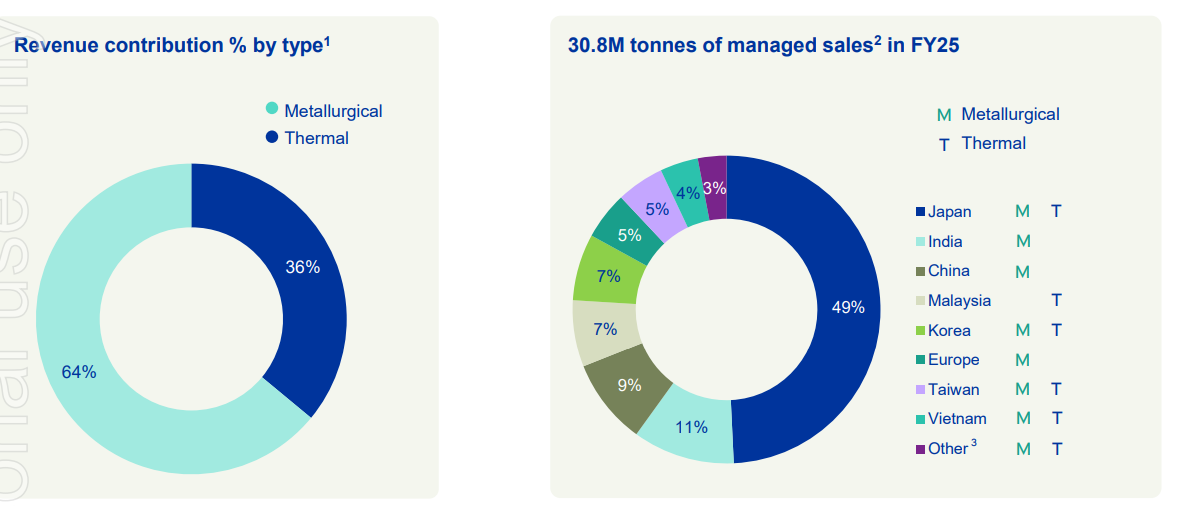

Portfolio Strategy: Whitehaven has undergone a transformational acquisition, which has enabled the business to transition from a pure thermal coal miner to a combined metallurgical (steel) and thermal coal business. This acquisition from BHP grants Whitehaven access to new mining assets with over 50 years of mine life at a very low price of 1.9 times earnings, and will result in a significant increase in company profits, regardless of any downward movements in the coal market. Whitehaven thermal coal mines produce one of the highest-quality coals, exported mainly to Japan, with low ash content. This means that Whitehaven Coal commands a premium in international pricing, and these mines are likely to be the last to close. WHC trades on 12x earnings and a 3.5% dividend yield based on a 50% payout ratio.

WHC finished up 3.1% to $6.63