Westpac Banking Corporation (WBC) released its full-year results for 2025, which were largely in line with market expectations albeit with a few pleasant surprises. Westpac is the first of the big four banks to report its full-year results this season, with MQG and NAB later this week, ANZ reporting full-year results next week, and CBA reporting its third-quarter results next week. The HNW Core and Income Portfolios hold a 7.7% weight to WBC.

Key Points:

- Profits Flat: Net profit slightly down at $7 billion with increases in interest income offset by increased spending on technology, including WBC UNITE technology program. Although total profit was down slightly, WBC benefited from its on-market buyback program, which resulted in flat earnings per share compared to last year.

- Low Bad Debts: Bad debts are virtually non-existent in Westpac’s results, with only 0.05% of loans currently impaired. Atlas continues to believe that the “riskier” loans now reside with private credit funds rather than banks, which are required to hold capital against these loans. “Bears” and those shorting the Australian banks have assumed that bad debts would swiftly move banks to long term average over .30% of loans, misunderstanding that the banks loan books are less risky than they were in 2007.

- Business Banking: Westpac increased its lending to businesses and institutions over the year, with lending rising by 13% and deposits increasing by 15%. The focus was on Agriculture, Health, and Professional Services, rather than the riskier industries such as construction.

- Strong Capital Funding: Westpac currently has a capital ratio of 12.5%, well above its long-term target range of 11.25%. This gives it plenty of leeway to complete its remaining $1 billion on-market share buyback. Since the start of 2021, WBC has decreased its outstanding shares by 7%.

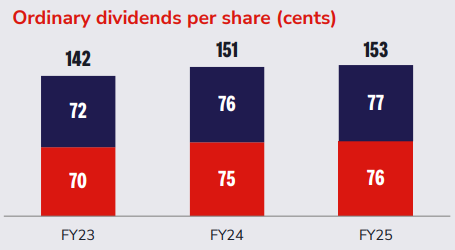

- Show me the Money: WBC announced a 1% dividend increase to $1.53 per share fully franked (See Below), representing a payout ratio of 75% of profits.

- Why is the Stock Up?: WBC’s business improved in the second half up +7% ex restructuring charge growing the loan book by $27 billion and increasing the banks net interest margin. Additionally the market was pleased about the growth in WBC’s business bank which was a surprise and suggests taking market share from NAB.

CEP Strategy: This was a solid result from Westpac, with the business travelling well. We own WBC in the portfolio due to its heavy exposure to mortgages which comprise 68% of WBC’s loan book. Through the cycle, mortgages have historically had much lower bad debt charges than business lending due to Australia’s home loan recourse lending and higher margins. We trimmed our WBC position in August and may do so again on further price strength, though the result showed that the bank is travelling well.

WBC finished up 3% to $39.82.