During the volatile February reporting season, the HNW Australian Equity Portfolio declined by -3.18% ahead of the index’s return of -3.79%, a disappointing outcome as we were pleased with reporting season in aggregate, though the certain stocks were very frustrating. The key news over the month was Australian companies reporting results, which was overlayed with an RBA rate cut and volatility from Trump tariffs, which led to a very bumpy month. Based on a solid January the Portfolio is in positive territory up +0.7% in 2025.

Performance was assisted by positions in Amcor (+4%), QBE Insurance (+3%), Medibank (+9%) and Bapcor (+3%). On the negative side of the ledger performance was hurt by Macquarie (-6%), ANZ (-3%), Ampol (-9%), CSL (-7%) and Min Res (-35%).

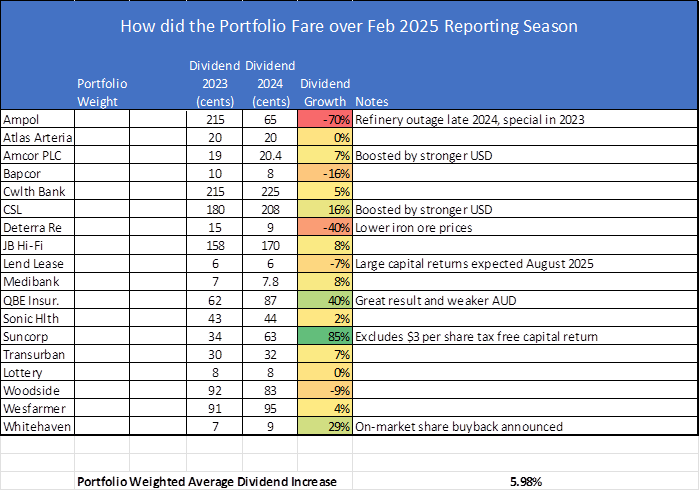

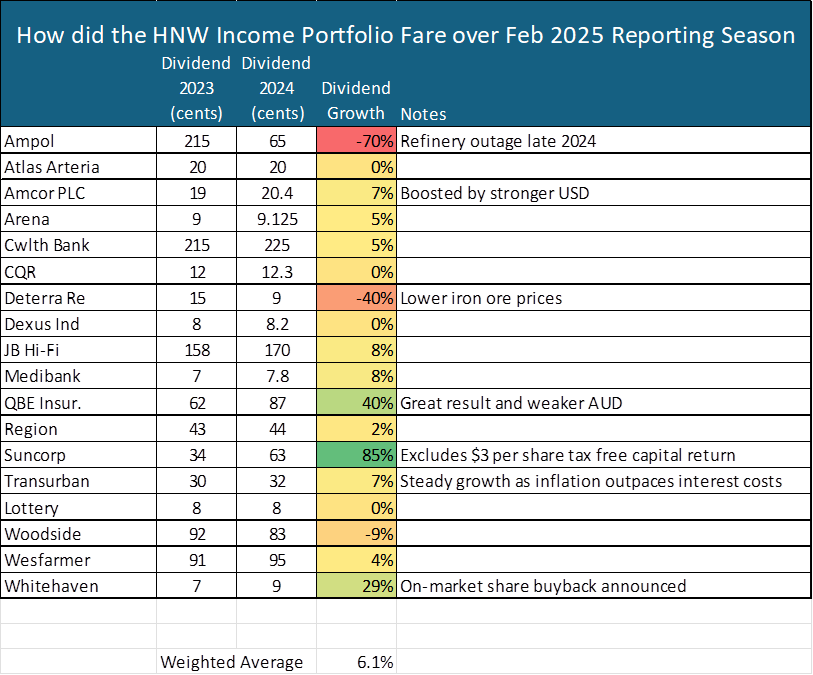

One of the key measures we use when assessing how we went during a reporting season is whether company boards are increasing dividends, we find that this removes some of the macroeconomic noise and future promises of company management, that may or may not eventuate. Companies can restate reported profits due to accounting issues, but dividends cannot be clawed back. Additionally, a board declares dividends based on more detailed financial statements and forecasts than are available to investors, so dividends can be seen as a signally mechanism of earnings quality.

It was pleasing to see portfolio companies, on average, increase dividends by +6% in the August reporting season, significantly ahead of the wider ASX 200 that saw a cut of -6%.

The HNW Equity Income Portfolio declined -2.97% behind its blended benchmark of -1.59%. Performance was assisted by positions in Amcor (+4%), QBE Insurance (+3%), Medibank (+9%) and Charter Hall Retail (+2%). On the negative side of the ledger performance was hurt by Deterra (-9%), Ampol (-9%), Arena REIT (-5%) and Min Res (-35%).

It was pleasing to see the HNW Income portfolio companies, on average, increase dividends by +6.1% in the August reporting season, significantly ahead of the wider ASX 200 that saw a cut of -6%.