Medibank Private (MPL): This morning, Australia’s largest health insurer reported its half-year 2025 results, which were very solid and saw the company try to minimise profitability. It is a politically astute move. The HNW Portfolio currently holds a 3% weight in MPL.

Key Points:

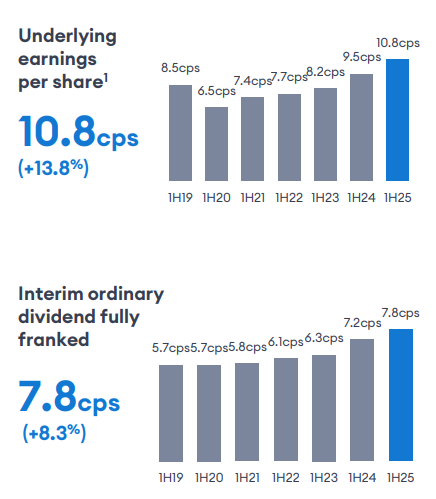

- Record Profits: Medibank recorded a net profit increase of +14% to $299 million, driven by a 3% increase in premiums, with a highlight of a +12% increase in non-resident (international students) policyholders as students continue to return following Covid-19 lockdowns.

- Medibank Health: Increased profits by 41% following increased uptake in homecare and telehealth revenue driven by patients undertaking more day surgeries so they can go home as soon as possible and still get the required consultations. It is far cheaper than paying a private hospital between $2K and $5K per day for a patient recovering.

- Investment Returns: MPL’s investment portfolio returned $115 million over the half, representing an increase of 37% on last year.

- Record Dividend: MPL announced a half-year, fully-franked dividend of 7.8 cents per share, representing +8.3% growth last year. The payout ratio represented a 72% payout of profits below the target range of 75-85%, which will see MPL return a strong dividend at the full-year result.

- Guidance: MPL did not provide explicit guidance but stated that they expect moderate increases to both policyholders and gross profit, driven by productivity savings across the business.

- Why is the stock up? MPL continues to benefit from positive jaws (revenues growing faster than insurance claims). Yesterday, the government announced a 3.7% increase in health insurance premiums for the next 12 months – ahead of MPL’s claims inflation of +2.2%.

Portfolio Strategy: We own MPL in the Portfolio as MPL’s healthcare earnings are defensive, and it is a well-run business. Despite its high market share, MPL’s gross margins and management expense ratios are higher than others in the industry, reflecting its recent experience operating as a government department. However, management has been slowly taking costs and improving margins.

Over the medium term, MPLs moving to improve their digital health experience and having patients treated at home rather than in private hospitals will drive profit growth, expand margins, and be a good outcome for recovering patients – and positive for MPL’s shareholders. In Atlas ‘ opinion, MPL investing in “in-home” care and rehabilitation is, a better use of shareholder’s capital than NIB’s risky investments in NDIS scheme managers and raises concerns about Ramsay Health’s long-term profits.

MPL finished up +10% to $4.42