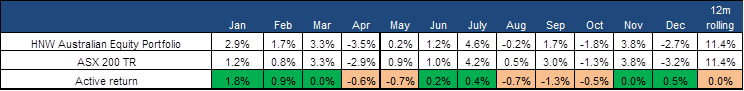

In December, the HNW Australian Equity Portfolio declined by -2.70%, slightly better than the ASX200 TR of -3.15%, with hopes of a “Santa Claus” rally on the ASX dashed by the US Fed, which indicated on the 18th December that 2025 would likely see fewer rate cuts than the market expected. Over the month, performance was helped by Transurban (+7%), Bapcor (+5%), JB Hi-Fi (+2%) and Min Res (+2%). On the negative side of the ledger, Amcor (-9%), ANZ (-8%), Incitec Pivot (-7%) and Sonic Healthcare (-5%) hurt performance on no news.

Atlas was surprised to see AMC, SHL, and IPL down in December due to the fall in the AUDUSD from 0.65 to 0.62. This -5% fall in the AUD in December will see the USD earnings and dividends paid in AUD of these companies automatically boosted by the fall in the AUD, which is now at its lowest level in 22 years. Bad news for skiing holidays in Aspen, but good news for companies earning profits in US dollars, which we have a large exposure to in the Atlas Portfolio.

2024 proved to be a solid year for Australian Equities, posting an above-average double-digit return and a similar return to what we saw in 2023. Atlas is pleased to see the Portfolio finish 2024 in the green, with both a positive absolute return and ahead of the benchmark.

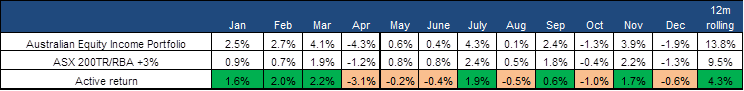

The HNW Equity Income Portfolio declined -2.7% which was behind the blended benchmark of -1.3%. Performance was helped by Transurban (+7%), JB Hi-Fi (+2%) and Min Res (+2%), with the detractors Amcor (-9%), ANZ (-8%), and Incitec Pivot (-7%). Income was very healthy over the month with IPL, TCL, RGN, DXI, CQR & ARF declaring distributions which will hit investors cash accounts in February.