The February 2025 reporting season kicked off today in a pleasing fashion.

Amcor (AMC) This morning at the Australian investor unfriendly time of midnight, the world’s largest consumer packaging company announced its results for the half year of 2025. Seeing the business continue to show volume growth from customer restocking was pleasing. The HNW Portfolios have a 4% weight to AMC.

Key Points:

- Profits and volumes up: Half-year profits increased by +5% to US$467 million, driven by a 2% growth in volumes across the business. Amcor’s Flexible range is the highlight of the result, with meat, dairy, liquids and fresh foods growing volumes by mid-single digits.

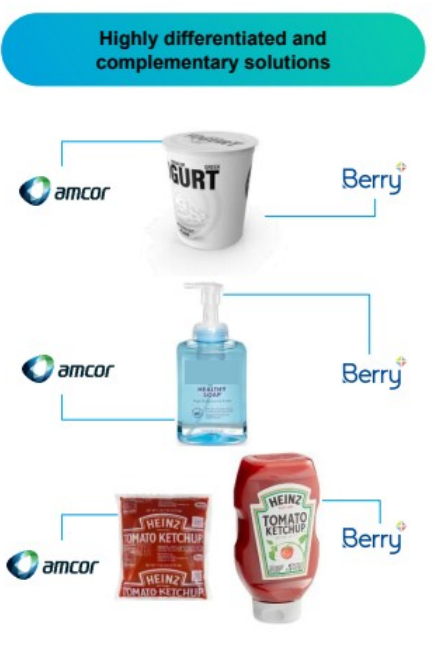

- Berry Merger: Amcor management is expecting to complete a merger with Berry Global in the middle of this year. The merger will create $650 million in synergies over three years and will widen Amcor’s packaging options to include containers and closures, highly complementary to Amcor’s flexibles range (See Below).

- What Tariffs? Although Amcor has an extensive network in North America, most manufacturing plants service regional clients within the US, which will see little to no effect from the proposed tariffs. AMC does have a small percentage of plants that import into the US, but these extra costs are passed back onto the customers through contracts once again not impacting AMC. Packaging plants are generally located as close to their customers as possible. For example, Amcor has a plant that we visited in Pennsylvania that is adjacent to a Pepsi plant, with AMC’s PET bottles coming straight into Pepsi’s via a conveyor belt. Conceptionally shipping empty bottles or packaging is akin to shipping air.

- Strong Balance Sheet: AMC’s balance sheet remains strong with $6.5 billion net debt or 3.3x leverage, well within expectations of what this type of business can handle, with management guiding to leverage being below 3x in six months before the Berry merger.

- Dividends Up: AMC announced a first-half dividend of A 20.4 per share, representing +7% growth on last year, with the falling AUD sweetening the dividend for our Australian investors

- Guidance: AMC management reaffirmed its guidance for earnings next year to be between 72 and 76 cents per share, representing 3-8% growth on FY24, driven by a better outlook for the business before the Berry merger. Management was confident about the synergies they could drive from the acquisition, making AMC the largest resin buyer globally. Atlas estimates a 15%-20% EPS uplift.

Portfolio Strategy: Amcor is the largest global packaging company with operations in 43 countries. While packaging is not the most exciting of industries, Amcor exposes the portfolio to global growth in consumer and medical goods and manufacturer demands for increasingly sophisticated packaging. Around 95% of AMC’s customer base is in consumer staples, such as packaging for meat, cheese, sauces and condiments, beverages, coffee, pet food, healthcare and personal care products, all of which have stable defensive characteristics. AMC trades on a PE of 13x with a full-year dividend yield of 5%.

AMC finished up 3% to $16.17.