In August, the HNW Australian Equity Portfolio declined by -0.19% trailing the ASX200 TR +0.47%, a disappointing outcome as we were pleased with reporting season as a whole. The key news over the month was a big fall (-6%) at the start of the month due to concerns about the US economy and the unwind of the Japan carry trade after the JCB raised rates for the first time since 2007, however the ASX rallied from 9th August onwards on better than expected corporate profit results to finish marginally in the black.

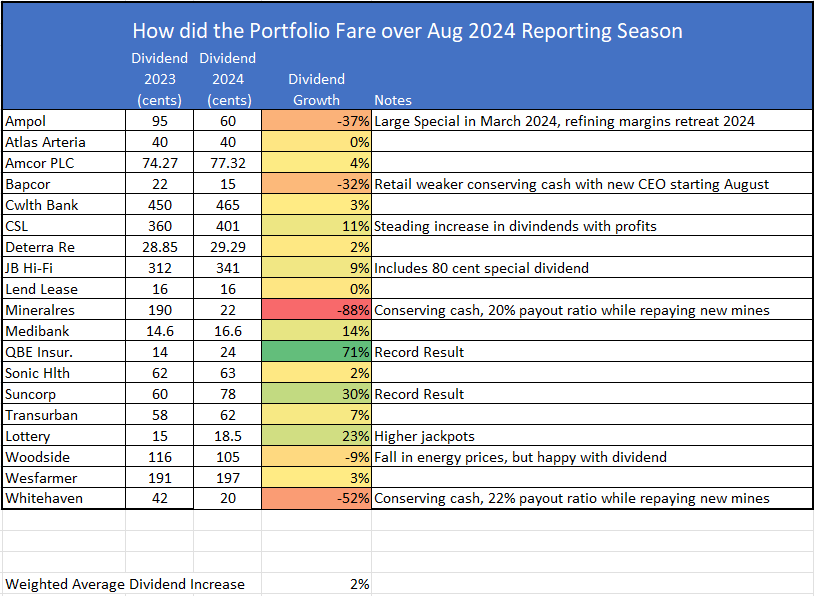

Performance was assisted by positions in JB Hi-Fi (+17%), Lend Lease (+9%), Westpac (+5%), ANZ (+5%) and Transurban (+4%). On the negative side of the ledger performance was hurt by Mineral Res (-26%), Ampol (-12%), QBE (-11%) and Deterra (-4%). It was pleasing to see portfolio companies, on average, increase dividends by +2% in the August reporting season, while this is below previous periods the Portfolio’s income growth, it was ahead of the wider ASX 200 that saw a cut of -5%.

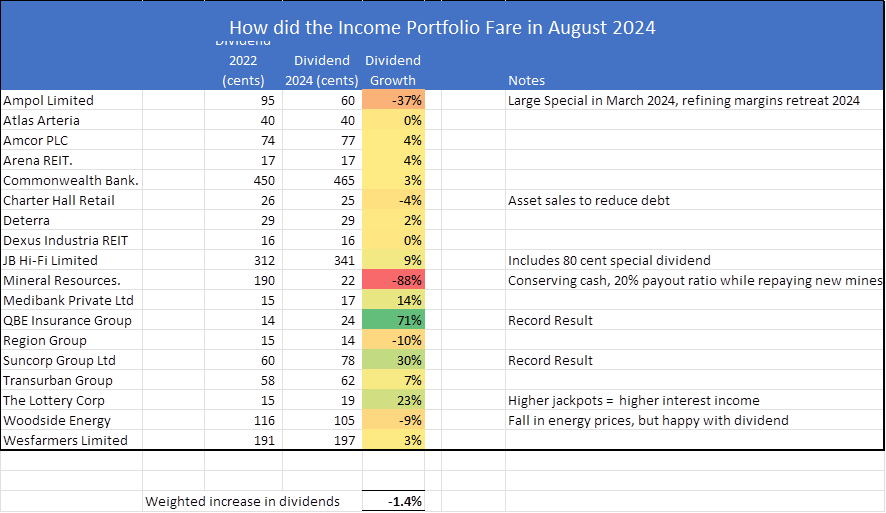

One of the key measures we use when assessing how we went during a reporting season is whether company boards are increasing dividends, we find that this removes some of the macroeconomic noise and future promises of company management, that may or may not eventuate. Companies can restate reported profits due to accounting issues, but dividends cannot be clawed back.

The HNW Equity Income Portfolio posted a small 0.05% gain, behind the Portfolio’s Blended benchmark of +0.54%. Performance was assisted by positions in JB Hi-Fi (+17%), Westpac (+5%), ANZ (+5%) and Charter Hall Retail(+4%) & Arena REIT (+4%). On the negative side of the ledger performance was hurt by Mineral Res (-26%), Ampol (-12%), QBE (-11%) and Dexus Industrial (-4%). Dividends were a feature of the month with 8 companies paying dividends.

Full Reports in to follow shortly.