Atlas Arteria (ALX) This morning, the Transurban of Eastern France, Atlas Arteria, released their first-half of 2024 results. Similar to Transurban, given the regular traffic and revenue updates, there were few surprises, and the result showed the resilience of ALX’s business. The HNW Growth Portfolio currently holds a 2% weight with the Income a 4.5% weight in ALX.

Key Points:

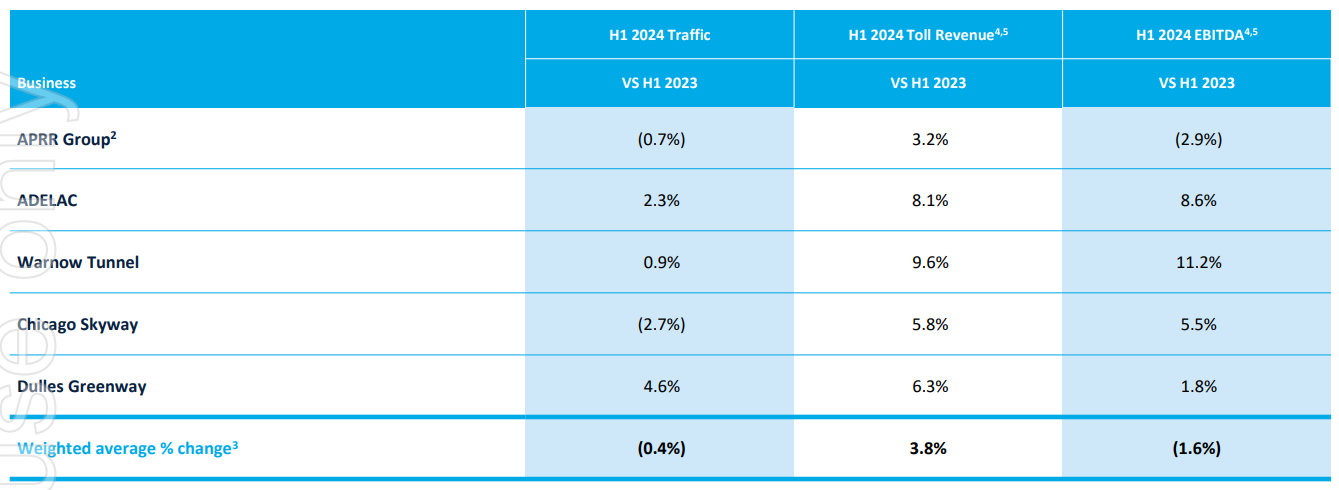

- Profits Down: Profits decreased by 16% to $114 million for the first half following a $31 million new tax on their French toll road assets. All of Atlas Arteria’s roads increased traffic and revenue minus APRR which was impacted by the farmers strike during the half which lowered traffic levels but still increased revenue. (See Below)

- French Tax: As of January 1, 2024, a new tax has been applied to companies operating long-distance transport infrastructure with annual revenues above €120 million and profit margins above 10%. This tax would apply to ALX’s flagship APRR toll-road system but would break the concession contracts signed by the government. ALX is currently waiting for a result for their constitutional challenge in the French government, if this is not successful ALX and their partners will proceed with litigation to seek compensation.

- Balance Sheet: ALX’s balance sheet remains strong with $230 million in cash and only $105 million in debt to be serviced over the coming year.

- Dividends: The half-year dividend is expected to be $0.20 and in line with a record first half dividend in 2023.

- Guidance: Management did not provide any concrete guidance but did provide guidance for the full-year 2024 distribution of at least $0.40.

Portfolio Strategy: ALX exposes the Portfolio to desirable monopoly assets and enjoys mandated price increases that protect our dividends against the ravages of inflation. While CV19 hit mobility and toll road revenue, traffic and revenue have rebounded far more quickly than the market expected. ALX is an under-researched stock that offers an attractive valuation, trading on a 7.3% dividend yield.

ALX finished down 0.5% to $5.06