This morning, Bapcor (BAP), Australia’s largest vehicle parts, accessories and equipment provider, reported results that had no new surprises as they provided a trading update in May. The HNW Growth Portfolio has a 2% weight to Bapcor.

Key Points:

- Profits Down: Net profit was down -24% to $95 million in line with, driven by weaker retail spending on high-margin discretionary items. Trade and New Zealand businesses both saw good profit growth throughout the half, growing at 2% and 8% respectively. Specialist Wholesale (Trucks) grew revenue during the year but was impacted by tougher trading conditions, which saw earnings fall 12% over the year.

- New CEO: Angus McKay will take over as CEO of Bapcor as of tomorrow. Angus was previously CFO of Fosters Group, Managing Director of Pacific National Rail, and, most recently, CEO of 7-Eleven since 2016.

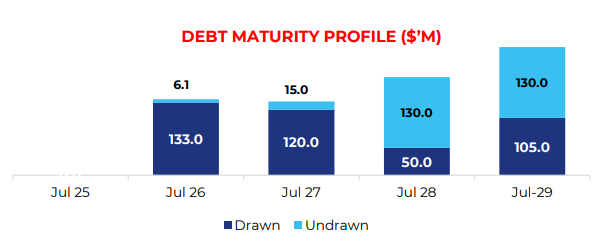

- Strong Balance Sheet: The balance sheet remains robust, with net debt remaining stable at $337 million and a leverage ratio of 1.7 times with no debt maturities until 2026. (See below)

- Dividend: Bapcor announced a dividend of 5.5 cents per share, representing a payout ratio of 54%, at the mid-point of their dividend policy.

- Guidance: Bapcor management didn’t provide specific guidance, but a trading update showed that sales across the business were up +8% for the first five weeks of FY25 and that they expect cost savings of $20-30 million in FY25 from a reduction in administrative headcount already made.

BAP finished up 2.2% to $5.04.

Portfolio Strategy: Bapcor provides the Portfolio exposure to automotive parts aftermarkets across Australia and New Zealand through motor vehicles (Burson), Trucks (Truckline), Agriculture (Bearing Wholesalers) and servicing (Midas). Bapcor benefits from the constantly aging car fleets of Australia and New Zealand that require more frequent servicing, with the average vehicle age increasing from 9.5 years before the pandemic to over 11 years now. Over the medium term, Bapcor will benefit from the transition to EVs, with many components of EVs needing more regular servicing. Bapcor trades on 14x forward earnings with a dividend yield of 3.4%.

In June, Bain Capital announced a bid for 100% of Bapcor for $1.83 billion or $5.40 cash per share, which was rejected by the Bapcor board the following month. This provides a floor for the share price, demonstrating an initial offer from a 3rd party for the business.