QBE Insurance (QBE) The global insurer released its full-year 2023 profit results, which showed that the company is managing its business well with few negative surprises, benefiting from positive trends in insurance management discussed throughout the year. The HNW Portfolios have a 4.5% weight to QBE.

Key Points:

- Record Profits: Net profit after tax +105% to US$1.36 billion with all parts of the business firing. Overall premiums were up a +10% increase in gross written premiums, particularly in their international segment, which saw an increase of +17%. Pleasingly QBE had a very good underwriting year, making insurance profits (premiums less claims and administration costs in all business segments.

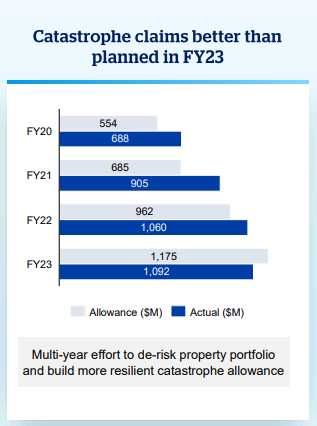

- Claims under control: This year is the first year in a very long time that QBE catastrophe claims have remained within their stated allowance, confirming the de-risking of their portfolio and building a more resilient catastrophe allowance. (See below)

- Investment Float the highlight: The net return on QBE’s investment float of $30.1 billion was $1.4 billion, representing a return of 4.7%, up from 2% a year ago. While this might feel like a small return improvement, it netted QBE an extra US$800 million in profits.

- Strong Balance Sheet: 1.80x the Regulatory capital minimum set by APRA whilst maintaining a gearing ratio of less than 22%.

- Increased Dividend: Up +59% to $A0.62 per share (10% franked), representing a lower payout ratio of 44%. In Atlas’ opinion this is a stingy payout from QBE, and we expected more in light of the strong capital position.

- Why is the stock off: 1) after years of double-digit growth in premiums, QBE have guided to mid-single-digit growth in gross written premiums throughout 2024 2) QBE were a bit miserly on the dividend payout.

Portfolio Strategy: QBE has a diverse class of insurance business lines across Australia, Asia, Europe and America and gives the portfolio exposure to both a falling AUD, rising interest rates and a hardening of insurance pricing globally. This result shows the benefits of the simplification drive over the past five years that has seen QBE jettison exotic businesses such as Argentinian workers comp, Columbian third-party motor, and Ecuadorian crop insurance acquired during QBE’s growth at all costs phase 15 years ago. QBE trades on a forward PE of 11x with a 6% yield based on a 50% payout ratio.

QBE finished down -1.7% to $16.11; despite this fall, QBE has been a solid citizen in the portfolio over the past year, up +24% vs the ASX200 +7%.