Charter Hall Retail REIT (CQR), the convenience retail real estate manager, posted strong earnings this morning, demonstrating the resilience of non-discretionary retail sales. The HNW Income Portfolio holds a 4.3% weight to CQR.

- Operating Earnings Up: Same property income increased by +4% to $78.6 million, driven by their convenience retailers, up +15%, which includes BP, Endeavour and Ampol. These leases are triple net leases, meaning if the tenant wants any capital works completed on the premise, it comes out of their pocket.

- Distributions Slightly Down: CQR announced a distribution of 12.3 cents up, -5%, representing a payout ratio of 91%. We are relaxed about this decline as it was due to $290 million of asset sales, conducted to pay down debt and reduce interest costs going forward.

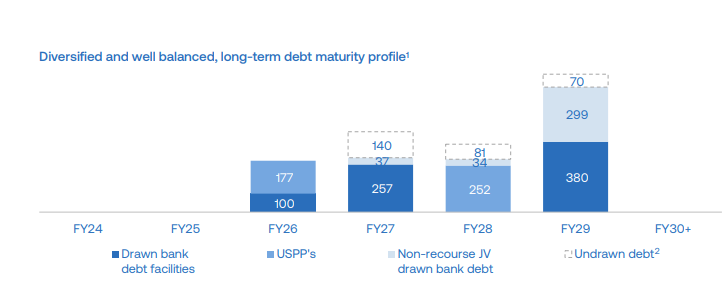

- Balance Sheet: CQR’s balance sheet was once in a strong position with a 24% gearing level with $290 million worth of divestments, bringing the gearing down from 27%. CQR has an average debt maturity of 3.6 years with no debt maturities before 2026. (See below)

- Discount-to-NTA: CQR NTA fell by 4% to $4.54 after 96% of the book was revalued at the end of December, representing a 16% share price discount. The discount comes after CQR sold four assets worth $290 million at or above book value.

- Outlook: CQR management has reaffirmed their guidance at the FY23 results of 27.4 cents per security, driven by positive leasing spreads over the coming half. This equates to a healthy distribution yield of 6.6%.

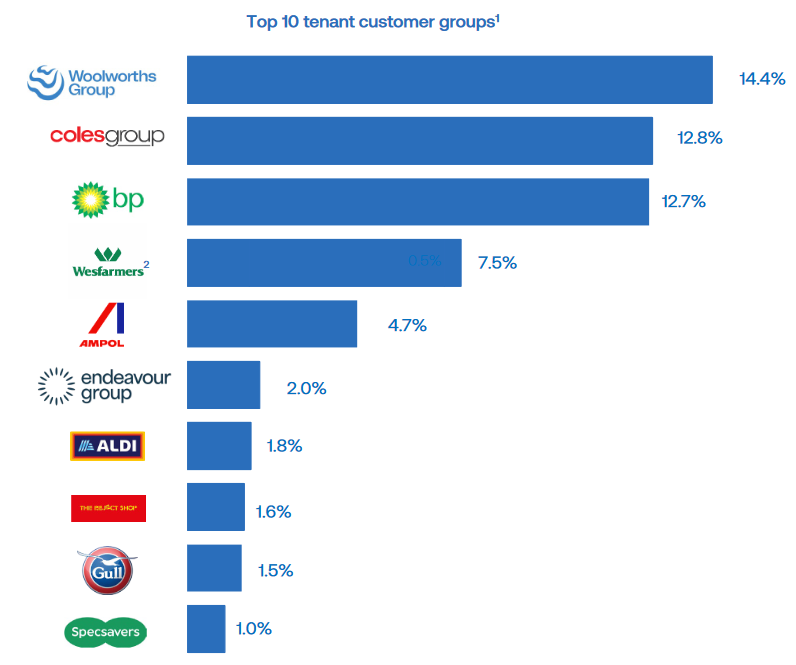

Portfolio Strategy: CQR offers exposure to non-discretionary retailing via a diversified portfolio of convenience retail and service stations. Unlike better-known retail landlords such as Scentre or Stockland, CQR’s tenants are not particularly exposed to the impact of online sales, with petrol, groceries and alcohol, as well as medical and personal services such as haircuts, not easily delivered online. Long leases linked to inflation to quality tenants such as Woolworths, Coles, Ampol and Aldi give a high degree of confidence that CQR can maintain and grow their distributions over time.

CQR finished up +2% to $3.82