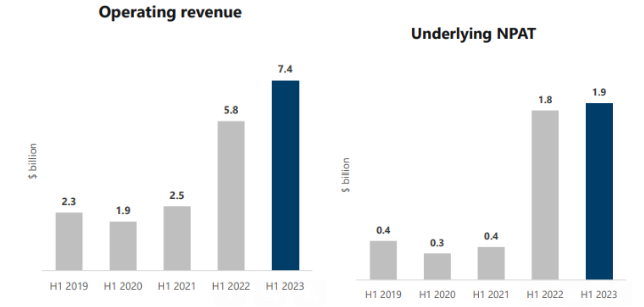

Woodside (WDS) released their half-year 2023 results this morning. These financial results were outstanding, reflecting excellent operational performance, new assets, and strong demand for LNG in North Asia. The HNW Portfolios have a 7.7% weight to WDS.

- Record Profits: Net profits of US$1.7 billion, up 6%, driven by a 66% increase in production volumes to 91.3 million barrels, partially offset by a decrease in realised oil and gas prices of US$74.0 per barrel as energy pricing normalised. Reliability was a highlight, with production close to 24/7 over the past six months. Unit costs remain low at US$7.90 a barrel.

- More Growth Projects: Due to having greater cash flows, thanks to the BHP Petroleum acquisition, Woodside can now take on more expansion projects, with 3 major expansions to be complete by the end of the decade. Prior to BHP Petroleum, WDS would have had to fund these through dilutive equity raises, high debt and project sell-downs. The Sangomar expansion is now 88% completed and will deliver WDS 23 new wells off the coast of Senegal, with the first oil expected in mid-24. Scarborough expansion is 38% complete, with targets of the first LNG in 2026, and Trion expansion received a final investment decision last month, with the first oil targeted for 2028.

- Record Dividend: The half-year fully franked dividend was US$0.80, another record and up +5%, representing an 80% payout ratio. For Australian shareholders, the dividend of A$1.16 represents a much greater 19% increase due to a weaker AUD.

- Balance Sheet: Woodside maintains an extremely strong balance sheet, with 8% gearing below their target range of 10-20% gearing. This is very impressive when the company has heavily reinvested within itself for expansions whilst distributing record dividends, though gearing will increase due to the abovementioned growth projects.

- Guidance: Woodside did not provide any concrete guidance but said they continue to expect the company to produce between 180-190 MMboe for full year 2023, helped by a North West Shelf Train turnaround. 2024 will see Sangomar LNG come online, which will add 36 million barrels of oil annually to WDS’ production.

Portfolio Strategy: WDS is the Portfolio’s sole energy exposure and is the most conservative and well-managed Australian oil company. WDS has the lowest production cost and gearing, an essential position for an energy company as conditions are not always as sunny as they currently are. WDS has minimal exposure to the East Coast gas market, where politicians are floating legislation requiring these LNG producers to break long-term 20-year export contracts with Asian utilities to reserve gas for the domestic market, which faces supply constraints due to moratoriums on new gas projects in NSW and Victoria. The company trades on an undemanding PE of 11.9x with a 6% yield based on US$70/bl oil. `

WDS fell -1% to $38.06. Over the past year, WDS has been a solid citizen in the Portfolio, up +26.6% vs ASX200 +5.6%.