Commonwealth Bank (CBA) reported its half-year results for 2026, which showed that the underlying business was operating solidly as Australia’s largest company. Due to the breadth of its lending activities, which touch every sector, CBA is closely watched for a read on the broader Australian economy’s health. The HNW Core Portfolio has an 7% weight.

Key Points:

- Record Profits: CBA reported profits increased by 6% to $5.4 billion, following market share gains across retail and business banking. For the last 12 months, all the banks have been highlighting the increase in mortgage competition within the mortgage market, mostly driven by Macquarie’s new offering. This was not seen in CBA’s results, with CBA growing in all business lines at or above the system.

- Net Interest Margin Down: Over the year, CBA’s net interest margin decreased by 0.04% to 2.04%, with increased mortgage competition slightly offset by increased volumes for both home deposits and business lending. During the call, management highlighted that they are expecting a tailwind from interest rate increases as mortgage rates increase before deposits.

- Bad Debt Remains Low: Declining to 0.06% of Gross Loans, Well Below the Long-Running Average of 0.3%. While unemployment remains low, Atlas expects banks’ loan losses will remain low, particularly when much of the more “exciting” high-yield lending to developers is not on bank balance sheets but rather with Private Credit Funds.

- Capital High: Tier 1 capital high at 12.3%, which is $10 billion higher than the capital requirement for the bank. Currently, CBA has $700 million left over from its $1 billion on-market buyback, which was last executed on November 15th 2024. Management is understandably reticent to buy back shares at current prices, so they will either keep their powder dry for a pullback or return capital via a special dividend in August.

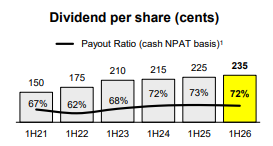

- Dividend up: CBA announced an interim fully franked dividend of $2.35 (See below), representing a 4% increase on last year. CBA also announced that it would fully neutralise its Dividend Reinvestment Plan (DRP), meaning that current investors are not being diluted, as CBA will buy roughly $450 million worth of CBA shares before distributing them to investors.

- Outlook: No direct profit guidance was provided, but management discussed that saving buffers have returned close to pandemic levels, meaning interest rate hikes are unlikely to see mortgage holders begin to stop paying their mortgages.

Portfolio Strategy: Following this result, Atlas maintains its view that CBA is the best bank in Australia; however, it is currently trading at a very expensive multiple, which has led Atlas to position CBA as a portfolio underweight. What to do with the banks in 2026 has been a key question for investors, as global investors started buying instead of shorting the Australian banks. Atlas have been slower than most fund managers to reduce our banks exposure due to the combination of buy-backs and lower for longer bad debts.

This result demonstrated the resilience of the CBA’s key profit centre, retail banking services, as high employment and a cleaner corporate loan book compared to 1991 or 2007 will result in lower bad debts (and higher profits) than the market expects. CBA is a well-capitalised Australian bank with a Tier 1 ratio of 12% after the dividend, and most of a $1 billion buyback ($700 million) remains to be completed.

CBA finished up +7% to $169.56, following strong growth across mortgages and business banking. A move that looks a bit excessive, on further strength we may look to trim the position.