This morning, Bapcor (BAP), Australia’s largest vehicle parts, accessories, and equipment provider, reported a trading update for the last quarter of 2025 and guidance for its August reporting season, which was below market expectations. The Funds Management Gods punished Atlas’ hubris revealed in the June newsletter, believing that we had escaped the May and June downgrades unscathed. HNW Growth has a 2% weight to Bapcor.

Key Points:

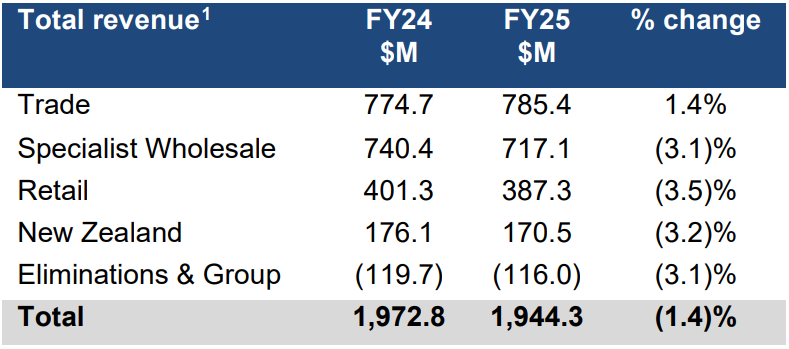

- Sales down -1.4%, driven by lower sales from specialist wholesalers (See Below) due to the consolidation of moving inventory away from small inventory sites to large-scale warehouse distribution centers, which will be a long-term benefit.

- Inventory Write-down During the half, Bapcor conducted a review of its balance sheet and identified $45 million of significant items that will be written down at the full-year result, primarily related to stale inventory valuation and site make-good liabilities, which are non-cash items.

- “Board Refresh”: Yesterday, three board member tendered their resignation from the company, with the remaining board accelerating the board refresh and search process. These were the three board members that voted against Bain’s $5.40 takeover offer last year. JA provided some intelligence this afternoon that this was a good move – but the market hated it.

- Cost-outs have been delivered towards the top end of the $20-30 million range, through investments in IT systems and cutting of transitional supply chain costs, which will benefit the business going forward.

Why is the stock down? The stock is down following the announcement of three board members’ resignations and the profit downgrade on the same day, a very unusual event. Today’s announcement looks to be the changing of the guard, with the new management announcing an inventory write-down and the remaining old directors exiting the business. Whilst the optics of the announcement are far from ideal, today’s announcement puts the business on a better path with a more capable board and management for what is a solid underlying business that has been mismanaged in recent history.

BAP finished down 28% to $3.66

Portfolio Strategy: Bapcor provides the Portfolio exposure to automotive parts aftermarkets across Australia and New Zealand through motor vehicles (Burson), Trucks (Truckline), Agriculture (Bearing Wholesalers) and servicing (Midas). Bapcor benefits from the constantly aging car fleets of Australia and New Zealand that require more frequent servicing, with the average vehicle age increasing from 9.5 years before the pandemic to over 11 years now. Over the medium term, Bapcor will benefit from the transition to EVs, with many components of EVs needing more regular servicing. Bapcor trades on 12x forward earnings with a dividend yield of 3%. Today’s price move is very alarming in context of the relatively small downgrade, we will review our investment post a one on one call with management.