Westpac Banking Corporation (WBC) released its full-year results, which came in line with market expectations, though we were pleasantly surprised about the buyback. Westpac is the first of the big four banks to report their full-year results this season, with Macquarie reporting last Friday. The HNW Equity Portfolio holds a 6% weight to WBC, with the Income Portfolio at 5.5%.

Key Issues:

- Net Profit Up Strongly: Westpac reported a +26% increase in net profit to $7.2 billion. Earnings per share were up +28% due to fewer shares in issue thanks to a $3.5 billion buyback in the second half of FY2022. Across the bank, WBC retail bank, business and institutional segments all produced solid results, with New Zealand weaker due to higher impairment charges.

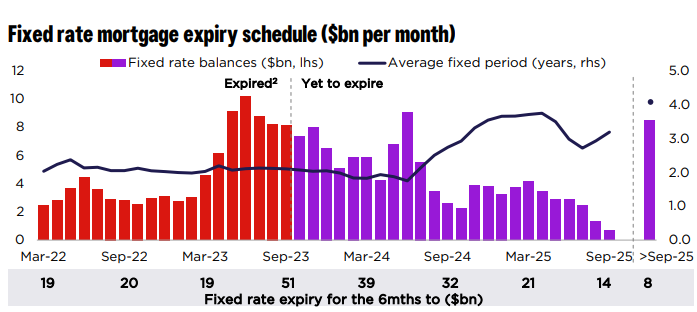

- Low Bad Debts: Although interest rates have increased by 4% over the last 18 months, there was no increase in bad debts, with WBC having an impairment charge of only 0.09% of loans. This was a pleasant surprise as many were looking for a spike in bad debts due to the fixed interest rate cliff.

- Slightly Lower Net Interest Margin (NIM): Core NIM for Westpac fell by 0.06% to 1.84% due to growing deposit competition over the last six months.

- Show Me the Money Part 1: Dividend up +14% to $1.42 per share, representing a 69% payout ratio (fully franked). WBC also announced they would neutralise their Dividend Reinvestment Plan, ultimately buying roughly $175 million worth of WBC stock, supporting the current share price.

- Show Me the Money Part 2: WBC announced today that they are starting a $1.5 billion on-market buyback to be completed over the next six months due to having $4 billion in excess capital from APRA’s revised capital standards. The announcement of capital management gives Atlas confidence that the board does not consider a sharp increase in bad debts imminent, as APRA would not have approved a reduction in WBC’s capital if things looked shaky.

- Positive Jaws: When looking at a bank result, one of the first things to look at is the difference between income growth and expenses. If income grows faster than expenses, the bank will have a positive Jaws ratio with a chart that looks like the open mouth of a crocodile. Due to the billions in revenue generated by a major bank, this is significant. In 1H23, Westpac’s operating income grew by 8%, while expenses decreased by 1%, an excellent outcome for shareholders which contributed to the strong profit growth in FY23

- Guidance: Westpac didn’t provide formal guidance but did cite that they are looking to prioritise higher earnings on capital. WBC also saw that they would have to have persistent inflation cost pressures and software spending but noted that most increased spending should be netted against bank cost savings.

CEP Strategy: This was a solid result from Westpac, with the business travelling well. We own WBC in the portfolio due to its heavy exposure to mortgages, which comprise 65% of WBC’s loan book. Through the cycle, mortgages have historically had much lower bad debt charges than business lending due to Australia’s home loan recourse lending and higher margins. While we expect loan losses to increase going forward, higher net interest margins will offset this.

We remain happy holders of the bank, which trades on a PE of 11x with a 9.1% fully franked yield (grossed up). Controlling costs was a highlight in the current inflationary environment.

WBC rose +2% to $21.92.