ANZ Bank (ANZ) released its full-year results, which came in just below market expectations, highlighting the increased competition in deposits and lending. ANZ is the last of the big banks to give their annual reports for 2023, with CBA to give its Q1 2024 update tomorrow. The HNW Equity & Income Portfolios hold a 6% weight to ANZ.

Key Points:

- Record Revenue and Cash Profit: ANZ reported a record $7.4 billion (+14%) full-year cash profit. At a segmental level, institutional and commercial had very solid years, with New Zealand and Australian retail posting more modest increases in profit.

- Positive Jaws: When looking at a bank result, one of the first things to look at is the difference between income growth and expenses. The bank will have a widening positive Jaws ratio if income grows faster than expenses. Due to the billions in revenue generated by a major bank, this is significant. In FYH23, ANZ’s operating income grew 13%, while expenses only increased by 6%. A great outcome for shareholders.

- Net Interest Margin (NIM): ANZ reported a group net interest margin of 1.65%, slightly down from 1.68% this time last year, driven by increased competition for mortgages and deposits in Australia and New Zealand and ANZ competing to grow its mortgage market share. In July, an Atlas staff member obtained a mortgage and chose ANZ as their offer was 10bps below the other banks.

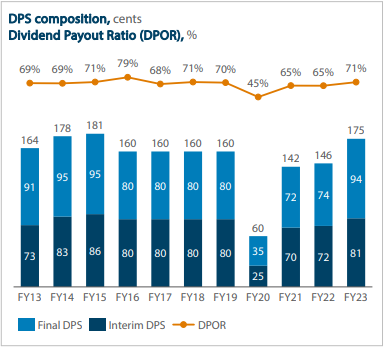

- Dividend above pre-CV levels (See Below): ANZ announced a final dividend of 94 cents per share, representing a 71% payout ratio and a full-year dividend of $1.75. The dividend consists of a 65% franked dividend of 81 cents and an additional one-off unfranked dividend of 13 cents per share

- Bad Debts & the Fixed Interest Rate Cliff? Loan losses in FY23 were close to zero, with ANZ coming it with the lowest of all the banks, a mere 0.01% of loans or a mere $93 million on a loan book of $707 billion.

- Guidance: ANZ did not provide any formal guidance for the coming year but did cite that they are looking to do more business on their ANZ Plus offering, which could substantially reduce costs over the next 5-10 years, and competition for mortgages and deposits will remain fierce.

- Why is the stock down? ANZ is trading lower today due to a lower net interest margin than the market expected, with ANZ competing to grow market share, particularly in mortgages.

CEP Strategy: We own ANZ in the Portfolio on both valuation grounds and the tailwinds the bank will enjoy over the next few years as the Australian banking oligopoly sees expanding profit margins from both rising rates and rationalising its branch network. ANZ trades on an undemanding PE of 9.9x with a dividend yield of 7.1% and will grow earnings per share in 2023 from both rising rates and increased market share with the Suncorp transaction.

ANZ declined -3% to $24.70 on what was an overreaction to an acceptable result.