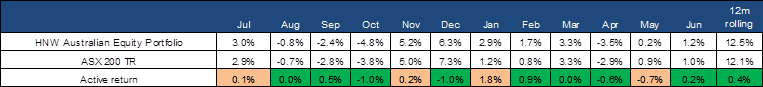

In June, the HNW Australian Equity Portfolio posted a 1.24% gain ahead of the ASX200 TR +1.01%. This marks the end of a satisfactory 12 months for the portfolio, though underperforming the index due to our caution towards miners. There was minimal stock-specific news in June, with companies in blackout prior to releasing their results in August. The key piece of news impacting the ASX over the month was the spike in inflation for May to 4%, which raises the spectre of an interest rate rise in August rather than the cuts that some market participants were forecasting.

There was a large degree of performance dispersion over the month, which was masked by the benign headline number. Performance was assisted by positions in Bapcor (+21%), Suncorp (+9%), Sonic Healthcare (+8%), Macquarie (+7%), CSL (+5%) and JB Hi-Fi (+5%). On the negative side of the ledger Min Res (-25%), Deterra (-14%) and Ampol (-7%) hurt performance mainly due to weakness in the iron ore price and questions around an acquisition from DRR. Atlas Arteria (-4%) and Whitehaven (-5%) were weak in June but have seen these losses recovered in July due to French elections and a surging met coal price after an explosion at a competitor’s mine will take a portion of global seaborn production out of the market for the foreseeable future

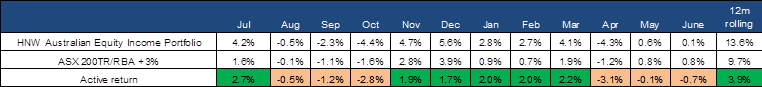

The HNW Equity Income Portfolio posted a small 0.12% gain trailing the blended benchmark’s return of 0.8%, though we are happy with the year as a whole on an absolute and relative basis. The positive and negative contributors in the Income Portfolio were similar to those in the growth portfolio with larger weights to Deterra and a position in Dexus Industrial (-5%) and no Bapcor the key differences.

June was a good month on the income front with Arena, Transurban, Incitec Pivot and Dexus Industrial all declaring dividends.