In June 2022 Suncorp announced that they had come to an agreement to sell the Suncorp Bank to ANZ, with SUN conducting a $4-5 per share capital return to shareholders and become a pure play insurer. Atlas saw this as a win win for both companies, both of which are held in the Portfolio.

Today the Australian Competition and Consumer Commission (ACCC) decided not to grant authorisation for ANZ Banking to acquire Suncorp’s banking arm. The basis for blocking the $5 billion acquisition was that the acquisition is likely to substantially lessen competition in the supply of home loans nationally, small and medium enterprise banking and agribusiness banking in Queensland. The ACCC did also note that a potential merger between Suncorp banking arm and Bendigo and Adelaide bank could increase competition amongst the retail banks.

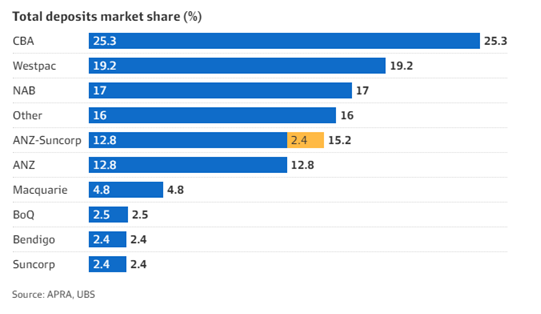

Currently, ANZ is currently the smallest of the retail banks with a market share of around 18% of Australian home loans and when combining with Suncorp’s 2.5% markets share, they only move ahead of NAB’s market share but still behind the likes of Westpac and Commonwealth Bank. In June this year, ANZ signed an agreement with the Queensland Government as part of the bank’s plan to acquire Suncorp. The agreement would have seen ANZ commit to establishing a major technology hub in Brisbane and work with Queensland universities to drive research and training in technology. This “bribe” was a clear sign that the Queensland Government was on side with the acquisition of Suncorp’s banking arm, and a win-win for both parties.

Both ANZ and Suncorp are set to appeal the ACCC’s decision to the competition tribunal to get it overturned with ANZ stating this morning they are continuing with preparations to integrate Suncorp Bank into ANZ.

Atlas’ see four potential outcomes if the ACCC blocking of the acquisition isn’t overturned:

1. Bendigo and Adelaide Bank make a bid for Suncorp’s banking arm

This seems to be an unlikely outcome due to the fact that ANZ bid $5 billion for the banking arm which is almost the size of Bendigo banks market cap! For this to eventuate Bendigo would need to more than double their share count and conduct a massive capital raise diluting all their current shareholders to have enough capital to make the bid of the same sizes as ANZ’s.

2. Merger with Bendigo Bank

A merger between the two banks, given they both have market shares around 2.5%, could be on the cards but it seems unlikely for shareholders to approve this on both side of the merger. For Suncorp shareholders this would be value destructive as shareholders would receive stock in a small regional bank that would have a higher cost of capital vs the bigger retailors. Conversely, Bendigo bank would have the struggles of trying to integrate two different business cultures into one uniform business, which requires upfront synergies and would most likely involve job cuts. Ultimately, a merging between these two smaller banks together doesn’t make one big bank but rather one smaller merged bank. See a fired up Atlas CIO in https://www.theaustralian.com.au/business/financial-services/bendigo-and-adelaide-bank-nodded-as-preferred-option-for-suncorp-but-challenges-await/news-story/24e18aa2e9a4d444a933b23fa353005d

3. Suncorp decides to keep the banking arm

Suncorp management have made it evident that they wish to solely focus and invest in the insurance arm of the business. Suncorp ideally want to sell the bank for cash so they can invest in digitisation, automation and cloud-based policy administration and claims systems, improving their position in the insurance market and benefit the public interests. If Suncorp was to retain the banking arm of the business, there capital resources would be spread out thinner to how it currently is.

4. Suncorp spins out their banking arm to make it a standalone bank.

Suncorp could spin out their banking arm as a separate business it would be in a worse position than if it merged with Bendigo bank due to the higher cost of capital and only 2.5% market share.

Earlier on Friday, SUN fell sharply on the news but recovered to finish up 1% at $14.13. ANZ similarly had a strong day on Friday, also up +1% at $25.45. The market has taken the view that this merger still goes through, but SUN may have to sell some of their Queensland agricultural business to another party such as BEN.