- Amcor (AMC). This morning, the world’s largest consumer packaging company announced its results for the first half of 2026, which is the first full half of operations post the Berry Merger. The HNW Portfolio has a 4.4% weight to AMC.

Key Points:

- Profits Up: First-half profits increased by +14% to $1.3 billion, driven by cost-saving synergies following the merger with Berry, which more than offset volume declines in non-core packaging segments. Amcor is expecting volumes to pick up in Q4 when the North American beverage season is in full swing. This was confirmed by Pepsi, which provided a quarterly update last night, announcing that it was looking to increase its market position by lowering prices by 15%.

- GLP-1 Contract Win: Amcor management highlighted a contract win for the packaging of a pill form of GLP-1 (e.g., Ozempic) in both the US and Europe. The main driving force behind winning this contract was the different packaging styles Amcor provides, with the European packaging being a flexible product and the US version being a Rigid package.

- Strong Balance Sheet: AMC’s balance sheet remains strong with $14 billion in net debt or 3.6x leverage, well within expectations of what this type of business can handle, with management guiding to leverage being below 3x over the coming year as some divestments flow through the business.

- Dividends Up: AMC announced a dividend of USD$0.65 per share, representing 2% growth on last year.

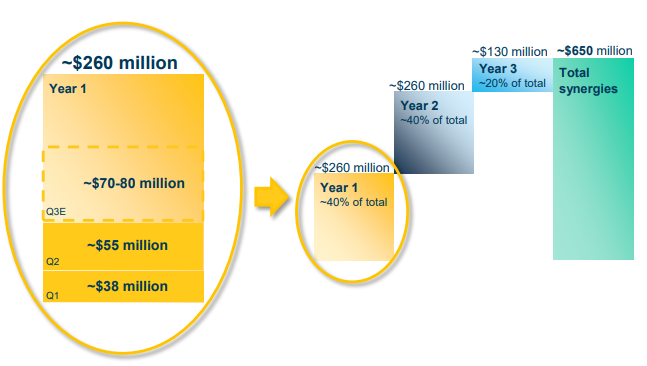

- Guidance Reiterated: AMC management reiterated their earnings guidance for next year of $4.00-$4.15 per share, representing 12-17% earnings growth. Management is confident the synergies coming from the Berry merger will deliver $260 million in cost savings next year.

- Why is the Stock Up: The stock is up following management’s clear expectations of achieving at least $260 million of cost out synergies this year, with $93 million achieved in the first half, regardless of the macroeconomic environment, as most of these cost savings can be done internally. (See Below). Amongst sell-side analysts, the prevailing view in 2025 was that AMC would achieve minimal to no synergies from the merger, yet are well on track to generating US$260M in year one.

Portfolio Strategy: Amcor is the largest global packaging company with operations in 43 countries. While packaging is not the most exciting of industries, Amcor exposes the portfolio to global growth in consumer and medical goods and manufacturer demands for increasingly sophisticated packaging. 95% of AMC’s customer base is in consumer staples, such as packaging for meat, cheese, sauces and condiments, beverages, coffee, pet food, healthcare and personal care products, all of which have stable defensive characteristics. AMC trades at an undemanding PE of 10x with a full-year dividend yield of 6%.

AMC finished up 3.5% to $65.31