Macquarie Group (MQG): This morning, the global investment bank reported its first-half results for 2026, which were solid, with the mortgage bank and asset management offsetting losses in commodities. The HNW Portfolio has a 6% weighting to Macquarie Group.

Key Points:

- Profits Up: Half-year profits up +3% to $1.6 billion, driven primarily by Macquarie Asset Management and Banking and Financial Services, which benefited from strong public market returns and growth in home loans. These profits would have been higher if Macquarie hadn’t taken the prudent move to impair some of its green assets, which included some offshore wind farms in the Americas. Commodities was weaker, not a surprise given lower commodity prices and lower volatility.

- Macquarie Bank: Profit from the bank increased by +22%, driven by a 13% increase in its home loan portfolio to 6.5% of Australian mortgages. Similarly, bank deposits increased by 12%, which provides Macquarie with funding flexibility across its banking balance sheet.

- Solid Balance Sheet: MQG currently has a solid capital ratio of 12.4%, which exceeds the APRA minimum capital target requirement of 11.5%. This leaves MQG in a strong position to support both asset growth and returning capital to shareholders.

- Dividends Up: First half dividend +8% to $2.80 (35% franked). In addition to the dividend, Macquarie still has $1 billion in on-market share buybacks to complete.

- Why is the Stock Down? The interim result was slightly below market expectations due to higher expenses in the commodities and global markets division; however, as always, MQG’s profit results are weighted towards the second half, with FY26 being no exception, given the data centres sale in October, which will settle in early 2026. The market was also a bit confused about the decision to reallocate its green investments (wind farms & solar) into its corporate unit for reporting purposes – Atlas sees that these are long term assets that will yield a better price if MQG can choose the time to sell them, rather than being forced to sell them into an unreceptive market by funds approaching their closure date.

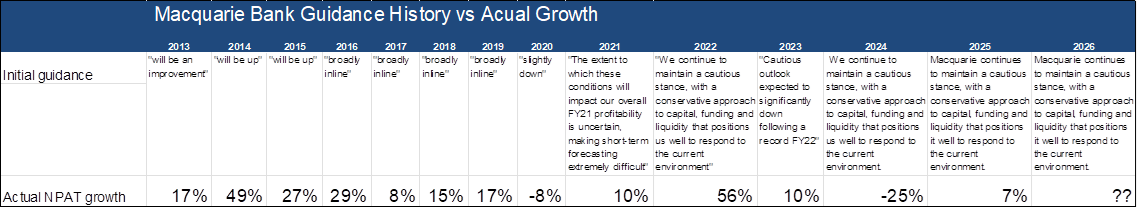

- Guidance: Macquarie management did not provide full-year guidance for any of its businesses but stated that it remains cautious in its approach to global markets and is well-positioned to respond to changes in the current environment. However, MQG’s US$40B sale of Aligned Data Centres to Nvidia will likely result in realised performance fees earned by their funds of between $1.5B and $2B, augmenting near-term earnings.

CEP Strategy: Atlas’ preferred bank exposure is Macquarie Bank, which offers exposure to a global investment bank with a heavy weighting towards stable funds management earnings and will benefit from a falling AUD. Unlike the major trading banks that operate in a competitive oligopoly where any moves to grow market share are swiftly matched by the other banks, Macquarie’s growth is not constrained by Australian GDP growth, with 65% of revenue coming from international markets. MQG offers investors both the “cake” of stable annuity-style profits from asset management to go with the “icing”, that is, the more volatile earnings that are derived from investment banking and trading in commodities and financial markets. MQG trades on an undemanding PE of 19x with a 3.3% yield.

MQG finished down -5% to $205 an overreaction to a small miss on an interim result, with the second half very likely to see accelerating profits.