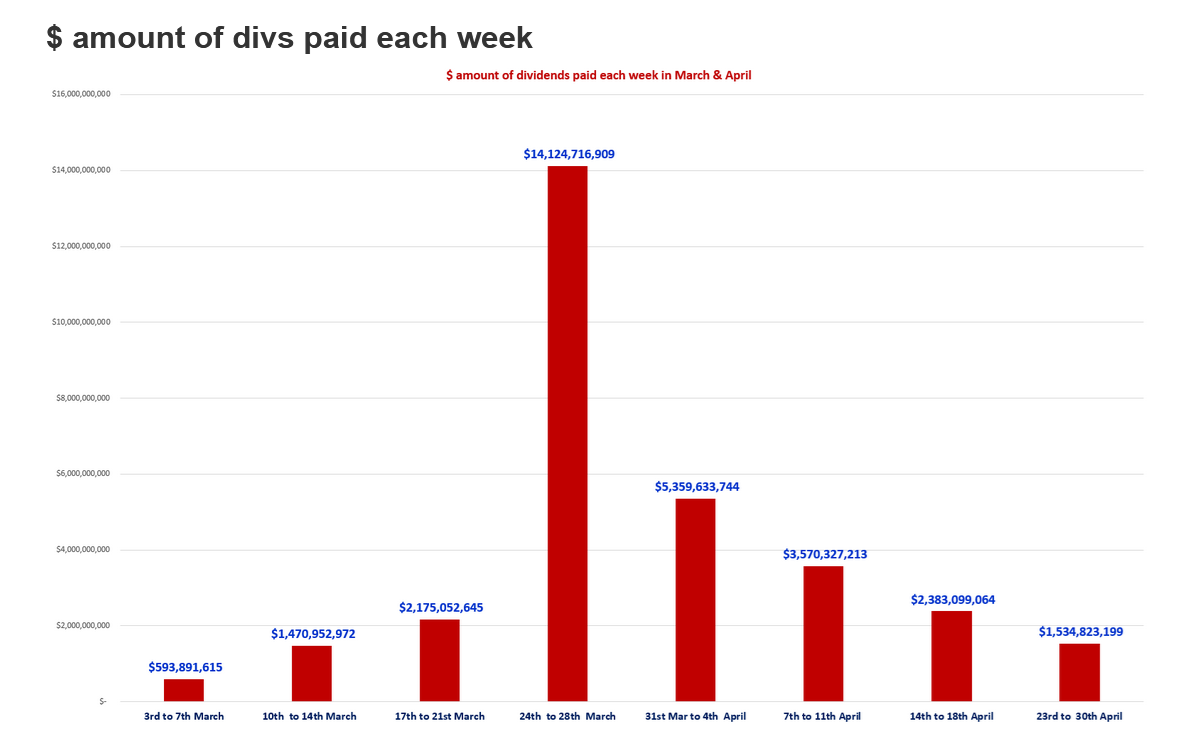

During March, the HNW Australian Equity Portfolio declined -3.17%, slightly ahead of the ASX 200 TR return of -3.39%. Outside of gold, there were few places to hide in March, with the spectre of Trump’s tariffs seeing a broad-based sell-off on the ASX. Australia was a relative outperformer in the month, falling less than Europe -4% or the USA -5.9%. The usual rally at the end of March and the start of April, as the Feb dividends hit investors’ bank accounts, did not materialise, with macroeconomic fears around tariffs and global growth dominating markets. As discussed on our Monday call, Atlas has run through the Portfolio and has trouble identifying how the tariffs will make any meaningful changes to the profits and dividends of the companies we hold, in particular those with operations in the USA.

Over the month, Min Res (+6%), QBE Insurance (+5%), Medibank (+4%), and Transurban (+2%) helped with performance. On the negative side of the ledger, Macquarie Bank (-13%), Ampol (-11%) and Dyno Nobel (-11%) hurt performance all on no new news, though we had a number of companies clustered around the ASX 200’s return.

The HNW Equity Income Portfolio declined -2.44% behind its blended benchmark of -1.39%. Positions in Charter Hall Retail (+7%), QBE (+5%), Medibank Private (+4%) and Transurban (+2%) assisted performance. On the negative side of the ledger, Macquarie Bank (-13%), Ampol (-11%), Dyno Nobel (-11%) and Arena REIT (-5%) hurt performance all on no new news.

Income was a factor over the month with 7 positions declaring dividends – this will see our cash position swell in April to 3%, with this moving to 4% in the HNW Income concentrated Portfolio.