Arena REIT (ARF): The listed childcare and medical centre owner reported their full year 2023 results which as always were consistent and steady. One of the key reasons we like ARF is the predictability of company earnings with 100% occupancy, government support and a lease term of 19 years there is not much scope for nasty surprises. The HNW Equity Income only has an 3% weight to ARF.

Key Points:

- Profits up: Net profit up +6% to $60 million due to the combination of annual rental growth, additional income from some acquired assets and new rental income from child centres developed in house by ARF. These gains offset an increase in ARF’s funding costs.

- Dividends Up: dividend 16.8 cents up, +5%, and a little weaker that earnings growth as ARF sensibly retains capital for their development pipeline.

- Operationally rock solid: ARF enjoys 100% occupancy and an average 19.3 years average weighted lease term, by far the best in the entire LPT sector. In November 2022 the Australian Federal Government’s Cheaper Childcare Bill successfully passed through the Senate. This increases the maximum childcare subsidy to 90% for the first child in care and 95% for the second and increases the earnings threshold for subsidies to $530,000 annual household income, so the taxpayer is helping the battlers on half a million a year, effectively underwriting ARF’s earnings.

- Balance sheet a highlight: ARF’s gearing remains low at 21%, with debt hedged for the next 4 years. Consistent with other companies in the portfolio we strongly prefer companies with lower levels of gearing as they face fewer issues than highly indebted companies in a rising rate environment. ARF’s is very conservatively geared compared with loan covenants of less than 50% and 2x interest coverage (currently 6x). Conversely earlier this week Charter Hall Long Wale REIT revealed gearing of 43% and announced plans to sell assets in a weak market to reduce gearing.

- Valuation Up!: ARF is likely to be the only Trust in 2023 that will post an increase in NTA, here by +1% to $3.42. Portfolio cap rate of 5.16% looks very conservative in light of recent transactions in childcare and health properties.

- Outlook: Full year 2024 distribution guidance 17.4 cents or +4% on FY23, 95% of the rent reviews due over the next 4 years are linked to CPI, so sustained higher inflation will flow through to company earnings along with earnings from new developments. Here we see the benefit of lower gearing for ARF.

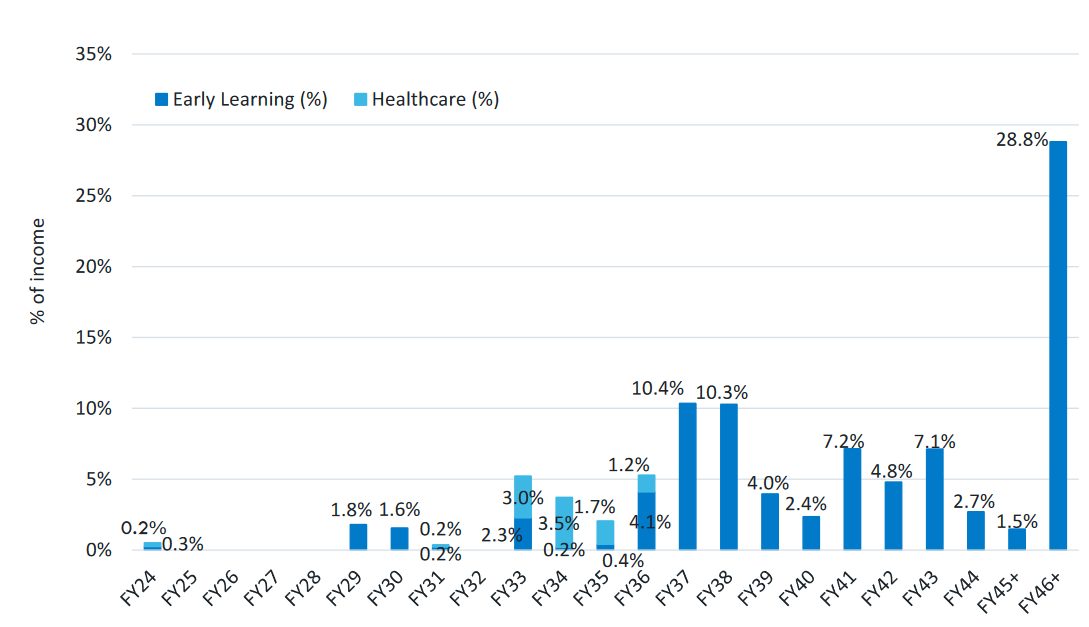

Portfolio Strategy: ARF is a well-managed company exposed to tenants offering very non-discretionary services such as child and healthcare, both of which enjoy bipartisan support. ARF pays a solid growing yield directly linked to inflation and is paid quarterly providing regular cash flow to our investors. The next major set of lease expiries are in 2037 and 2038, so we have few near and medium term concerns.

ARF finished flat at $3.82 in a result that was largely ignored on a heavy day of reporting.